Akquisitionsfinanzierung - M&A Debt Advisory

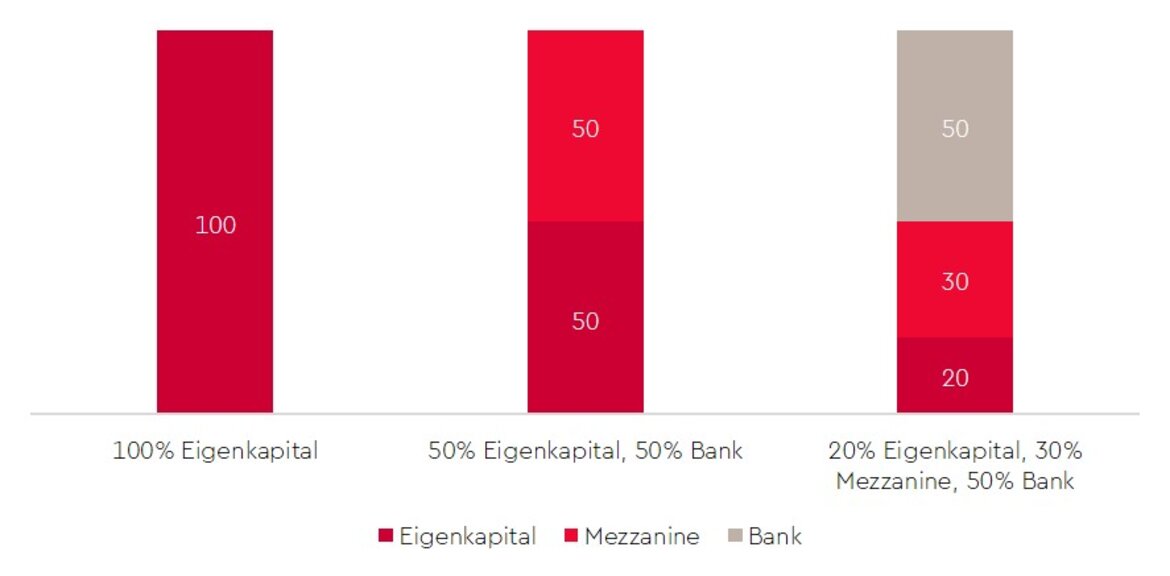

Im Rahmen der M&A-Strategie stellt sich neben der Suche nach dem passenden Zielunternehmen bzw. Käufer immer auch die Frage nach der Finanzierung der Transaktion. Je nach Branche, Geschäftsmodell und Risikoeinschätzung der Investoren oder Eigentümer bzw. der Geschäftsleitung ist eine Bandbreite von einer reinen Eigenkapitalfinanzierung bis hin zu einem maximalen Einsatz von Fremdkapital zu beobachten. Auf Basis dieser Überlegungen zur M&A- und Finanzierungsstrategie gilt es, die grundsätzlichen Finanzierungsmöglichkeiten zu analysieren. Hierbei kommt es auf die Bonität, den Cashflow und somit die Kapitaldienstfähigkeit des erwerbenden Unternehmens, des zu erwerbenden Unternehmens sowie z.B. einer Zweckgesellschaft zum Erwerb des Zielunternehmens an. Je nach Höhe des fremdfinanzierten Anteils des Kaufpreises kommen neben klassischen Banken auch alternative Kreditgeber wie z.B. Mezzanine- oder Debt-Fonds in Frage. Generell sollten der Komplexitätsgrad und der zeitliche Aspekt einer Akquisitionsfinanzierung nicht unterschätzt werden. Der Aufwand lohnt sich aber, wenn am Ende die hinsichtlich Risiko oder Rendite optimale Finanzierungsstruktur steht und ein anfangs nicht zu finanzieren scheinender Deal doch finanziert werden konnte.

Beispielhafte Finanzierungsstrukturen für M&A-Transaktionen:

Buy-Side-Finanzierungen erweitern die strategischen Optionen bei M&A-Transaktionen

Jedes Unternehmen steht vor der Herausforderung, sein verfügbares Eigenkapital optimal einzusetzen. Insbesondere bei einer so kapitalintensiven Entscheidung wie der Akquisition eines anderen Unternehmens stellt sich die Frage, wie viel Eigenkapital eingesetzt werden kann bzw. soll und wo der optimale Fremdkapitalanteil (Leverage) und somit das optimale Chance-Risiko-Verhältnis einer Transaktion liegt. Hierbei gilt es insbesondere zu beachten, dass Akquisitionsstruktur und Finanzierungsstruktur Hand in Hand gehen und von Anfang an aufeinander abgestimmt werden sollten. So ergeben sich bei einer Mehrheitsbeteiligung und damit verbundener Konsolidierung z.B. Finanzierungsmöglichkeiten auf Basis der Bonität des zu erwerbenden Unternehmens.

Unser Ansatz im Bereich der Finanzierung von Buy-Side-Aktivitäten

Aus unserer Sicht ist es besonders wichtig, dass der Aspekt der Finanzierung in die M&A-Aktivitäten von Anfang an mit einbezogen wird, um die Suchkriterien optimal definieren zu können. Dem entsprechend begleiten wir die Buy-Side-Finanzierung über den gesamten Prozess hinweg:

- Ausarbeiten der optimalen Finanzierungsstruktur (Eigenkapital, Fremdkapital, Mezzanine, Verkäuferdarlehen etc.)

- Abgleich, ob die geplante Erwerbsstruktur und die Finanzierungsstruktur Hand in Hand gehen

- Aufbereitung der Unterlagen für die Ansprache von Banken / Debt Fonds

- Begleitung der Gespräche mit Banken/Debt Fonds

- Optimaler Weise Vereinbarung einer sogenannten Hunting Line mit Banken / Debt Fonds, um die Akquisitionsstrategie flexibel und reaktionsschnell umsetzen zu können

Unser übergeordnetes Ziel bei all diesen Aktivitäten ist es, die Umsetzungswahrscheinlichkeit von Transaktionen für unsere Mandanten zu erhöhen und optimalerweise durch einen Vorteil bei der Umsetzungsgeschwindigkeit auch Vorteile bei Verhandlungen mit Verkäufern zu generieren.

Sell-Side-Finanzierungen optimieren den Verkaufsprozess und erweitern das Käuferspektrum

Im Grunde genommen wechseln wir im Vergleich zur Buy-Side-Finanzierung lediglich auf die andere Seite des Verhandlungstisches. Wäre es nicht optimal für einen Unternehmenskäufer, wenn er sich um die Finanzierung des Kaufpreises keine Sorgen machen müsste, weil der Verkäufer einen Finanzierungsvorschlag seiner Bank mit an den Verhandlungstisch bringt? Dieser Finanzierungsansatz des sogenannten Stapled Finance ist im M&A-Finanzierungsmarkt recht weit verbreitet – den Verkäufern von Unternehmen dagegen unserer Erfahrung nach weniger geläufig.

Unser Ansatz im Bereich Sell-Side-Finanzierung

Um potenzielle Finanzierungspartner rechtzeitig einbinden zu können, sollte das Thema Sell-Side-Finanzierung möglichst früh im Veräußerungsprozess adressiert werden. Die M&A-Spezialisten der WTS Advisory verfügen über ein umfangreiches und belastbares Netzwerk von Banken und Debt-Fonds, um einen passenden Partner für das Thema Stapled Finance zu gewinnen.

Konkret können wir unsere Mandanten im Bereich Sell-Side-Finanzierung wie folgt unterstützen:

- Laufende Abstimmung von Finanzierungskonditionen mit unseren Netzwerkpartnern im Bereich der Banken und Debt-Fonds sind die Basis für unsere Services im Bereich Sell-Side-Finanzierung

- Mandanten- und projektbezogene Aufbereitung der Unterlagen & Begleitung der Gespräche mit Banken und Debt-Fonds

- Verhandlung mandanten- und projektbezogener, individueller Konditionen mit dem Ziel eines Termsheets mit den Eckpunkten der Finanzierung

- Beifügen des Termsheets bzw. des Finanzierungsvorschlags zum Investment Memorandum („Stapled Finance“)

Das erklärte Ziel unserer Aktivitäten im Bereich der Sell-Side-Finanzierung ist es, für unsere Mandaten den Verkaufspreis zu maximieren sowie die Umsetzungswahrscheinlichkeit und die Umsetzungsgeschwindigkeit zu erhöhen.

Bei Interesse und für Fragen stehen wir Ihnen gerne zur Verfügung.

Ihr Kontakt zu uns

Sie haben Fragen zu unseren Services oder der WTS Advisory? Wir freuen uns auf Ihre Nachricht oder Ihren Anruf!