TACKLING PLASTIC POLLUTION AND WASTE AT THE EUROPEAN AND NATIONAL LEVELS

The European Union’s legislation regulating plastic waste

The issue of plastic packaging waste has been at the forefront of European policy thinking in recent years. On 1 January 2021, the European Union (EU) introduced a levy based on the amount of non-recycled plastic packaging waste produced by each EU Member State (‘MS’). This ‘plastic levy’ has been designed to reduce the proliferation of non-recycled plastic waste while concurrently funding the 2021–2027 EU budget against the backdrop of the increased spending arising from the pandemic. Each MS is required to pay a levy determined by multiplying a rate of EUR 0.80 per kilogramme by the weight of non-recycled plastic packaging waste. While some MS have been paying the levy out of their national budgets, others have introduced (or are looking to introduce) new taxes, duties, charges, fees, or contributions on plastic products, or have extended (or are considering extending) existing schemes to tax plastic products as well.

Furthermore, since 3 July 2021, the EU has banned certain single-use plastic products such as cotton bud sticks, cutlery, plates, straws, stirrers, and sticks for balloons under EU Directive 2019/904 on Single-Use Plastics (‘SUP’). For other single-use plastics, the SUP Directive has introduced several measures, such as waste management and clean-up obligations for producers (such as the Extended Producer Responsibility Schemes), which aim to reduce the quantities of these products. Under Article 8 SUP Directive, the MS need to ensure that the producers of single-use plastic products cover the costs of cleaning up litter resulting from these products and the subsequent transport and treatment of that litter. This provision has resulted in some MS introducing the so-called ‘littering levy’.

Additionally, the EU has introduced rules on packaging and packaging waste to harmonise national measures tackling the problem of increasing quantities of packaging waste. One of the SUP Directive’s requirements has been to ensure that producer responsibility schemes are established for all packaging by the end of 2024.

Furthermore, a new Packaging and Packaging Waste Directive (‘PPWD’) entered into force in February 2025 and will apply from August 2026. It increases the pressure on the MS to harmonise Extended Producer Responsibility (‘EPR’) by requiring each MS to set up a register of producers and setting up an EU-wide minimum requirement for EPR.

Thus, these developments create a very complex and complicated system where plastic producers, distributors, and consumers need to be aware of the numerous measures in each country, as these measures differ across Europe.

For further information about Environmental Taxation, visit our Sustainability and Tax section at wts.com

PLASTIC TAXATION AND LEVIES IN THE MEMBER STATES

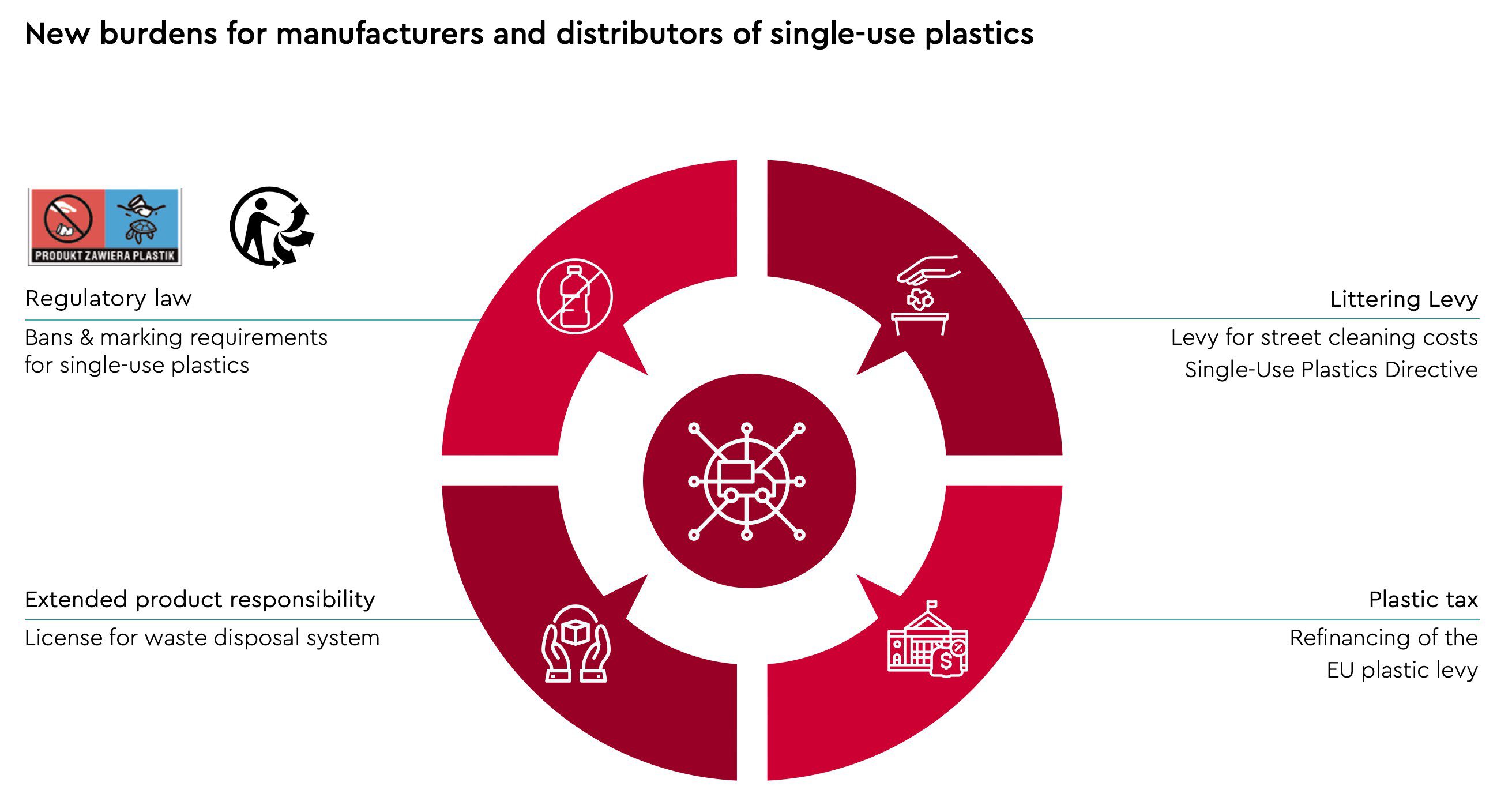

In recent years, the MS have started to implement the European Waste legislation as well as their own national rules and measures to tackle the issue of plastic waste. Currently, there exist various combinations of laws and levies and taxes applied differently by each MS. The existing measures can be categorised into 4 categories:

- Plastic and Plastic Packaging Taxes (‘PPT’);

- Regulatory bans and marking requirements for SUP

- EPR fees and licence requirements for waste disposal systems;

- Littering levies.

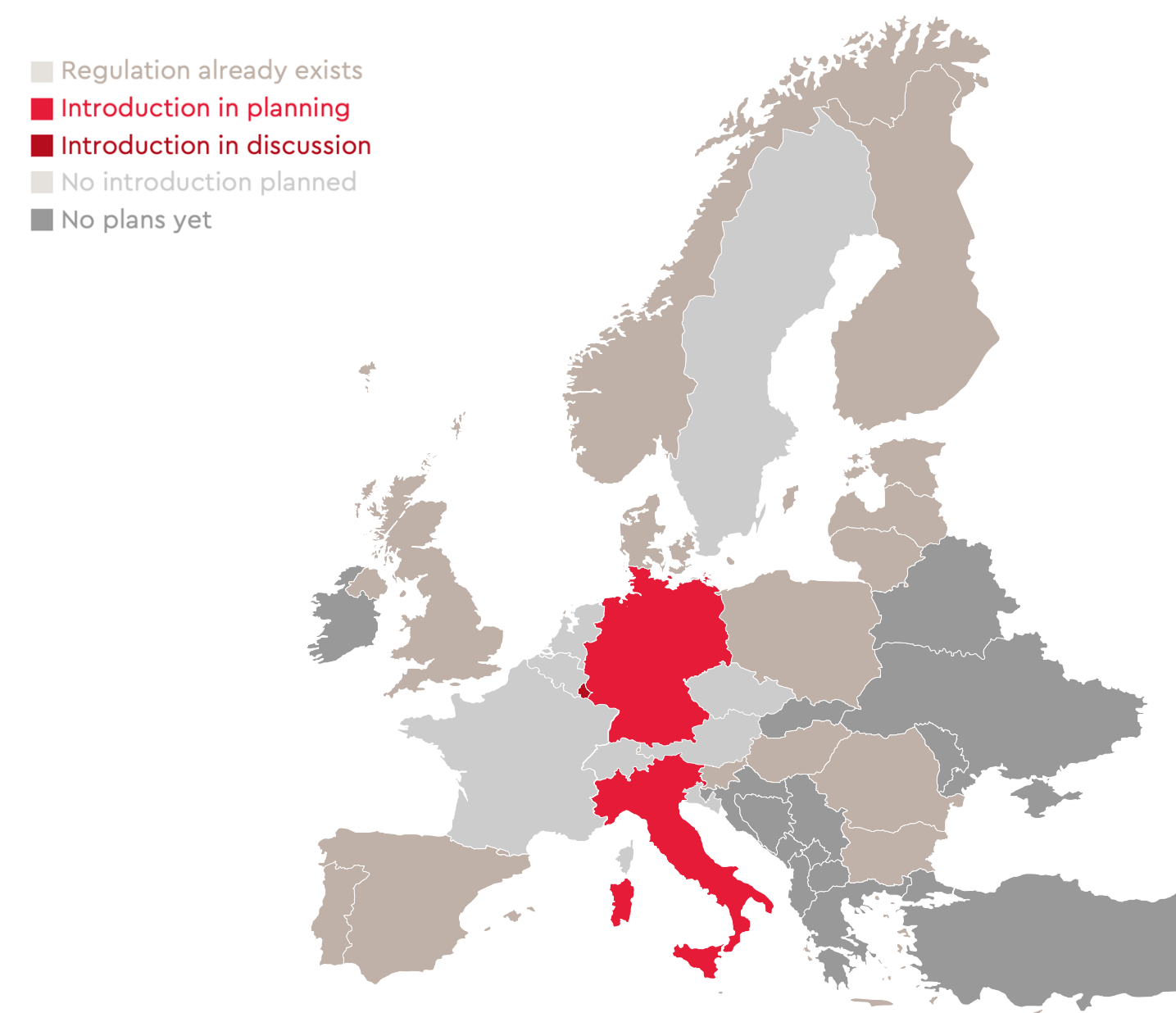

Among the MS that have implemented some kind of plastic tax, the tax design varies greatly. Some focus on packaging (i.e. both plastic and non-plastic packaging), while others are narrower in scope, targeting single-use or non reusable plastics only. Some MS are imposing a tax on domestic and foreign�sourced plastic products, whereas others are relying on an excise tax mechanism to exclusively target foreign-sourced plastic products. The list of exempt products also differs from one MS to another. Crucially, the rate of tax varies across the MS, with some choosing not to levy a tax at all.

What has emerged is a patchwork of uncoordinated national and regional rules that require careful examination and navigation by enterprises operating in multiple MS. The EU is aware that an uncoordinated approach, fragmented rules, and vague requirements are creating barriers within the internal market and additional costs for economic operators. However, since taxation is a national competence and passing any tax legislation requires unanimity at the Council of the EU level, it is highly unlikely that we will see an EU Plastic Taxation Directive anytime soon. The only measure that the EU has recently undertaken is the PPWD, which attempts to harmonise more the EPR requirements as well as other requirements concerning recyclability and labelling.

CHALLENGES FOR ENTERPRISES

For business operations, the existence of a plastic tax and other levies can have wide-ranging implications for an enterprise’s internal processes and procedures. As a preliminary step, the enterprise will need to familiarise itself with the types of plastic taxes and levies that are imposed in each country in which it operates and ascertain which of its local entities is liable to pay the tax or levy. Depending on which entity within the supply chain is liable, there may be invoicing and pricing implications to consider. Thereafter, the enterprise will need to identify the employees responsible for handling compliance and provide such employees with relevant training to enable them to adequately perform their duties. The enterprise’s tax and legal departments must also be prepared to support the additional compliance obligations. The enterprise must also be able to single out the types of materials or products that are subject to tax from within its supply chain, and its enterprise risk management systems must also be adapted to handle these compliance requirements.

To help companies make sense of this rapidly growing area of taxation, at WTS Global we are always building upon our competence and expertise in this field to provide both national and cross-border support to our clients. This current report serves as a reference for supporting companies when navigating tax issues arising from the manufacture, importation, distribution, or use of plastic products, and also with initiating deeper thinking about how plastic value chains can become more circular.