Liquidity Management by using Liquidity Planning

Regardless of a company's liquidity situation, liquidity management is a mandatory part of corporate management. This applies to small and medium-sized companies as well as large corporations. As a basis for liquidity management, centralized liquidity planning has become the norm. The implementation of efficient and automated liquidity planning enables effective liquidity management with sufficient time for the evaluation and analysis of the results and the derivation of any necessary optimization measures.

Implementation of professional liquidity planning

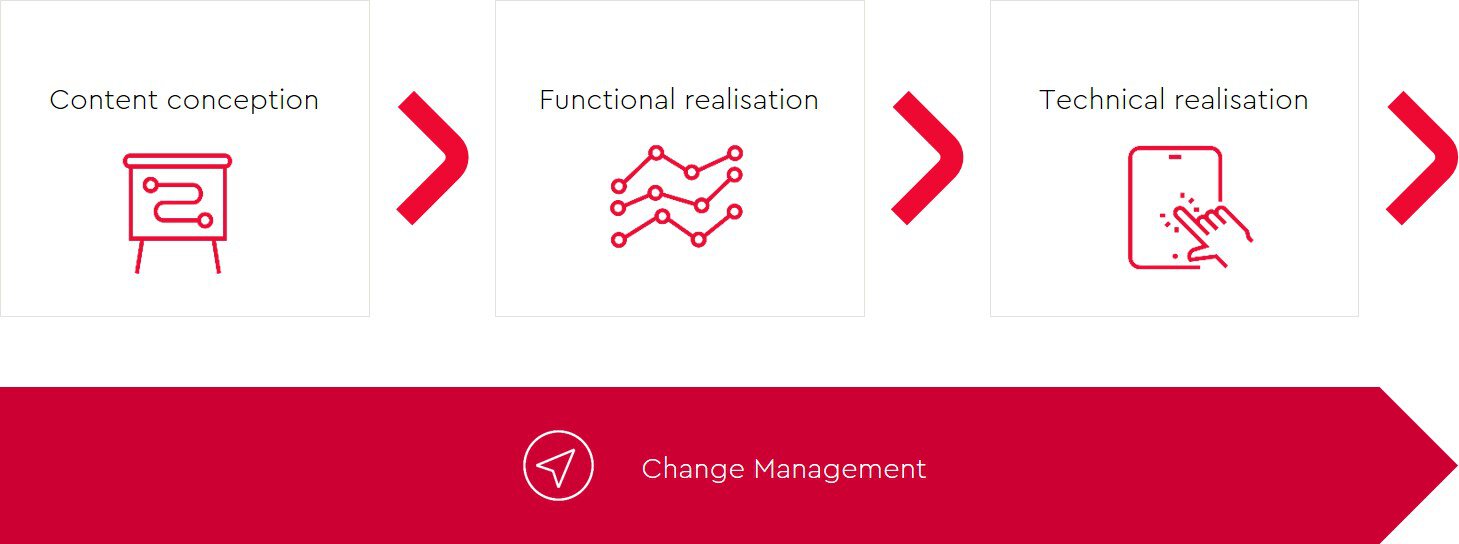

Liquidity planning is generally implemented in three stages. The concept stage starts with the identification of the main liquidity drivers and sources of information. This is followed by an individual definition of the planning methodology, planning structure and planning process, depending on the purpose of the liquidity planning and the size and stage of development of the company. Detailed modeling of the individual planning data takes place as part of the technical implementation. The cash flows can be determined by transfer, calculation, derivation from other plans or supported by statistical analyses ("predictive analytics"). Planning parameters and planning assumptions should be defined centrally as far as possible in order to ensure planning consistency.

In addition to special planning solutions, the technical implementation of liquidity planning can be carried out in the planning modules of any existing corporate performance management or treasury management systems (digitizing companies). By connecting ERP systems (market data platforms, etc.) via automatic interfaces, the basis for further automation of plan data determination is established. The system-supported implementation also provides the necessary infrastructure for the consolidation of individual plans, the stable supply of information to management and adequate analysis options for employees in the finance department.

In addition to the functional and technical implementation, the liquidity planning process should be anchored as broadly as possible in the company's organization as part of a change management process. All departments that can trigger incoming or outgoing payments and whose decisions influence liquidity-relevant cash flows should be involved.

Optimierte Liquiditätssteuerung

During the planning process, it is especially important to strictly adhere to the planning process. We recommend working through a centrally defined checklist. In addition, a binding discussion should be held with all key suppliers in the planning process. The results of liquidity planning should be distributed promptly in a simple, visualized and commented report.

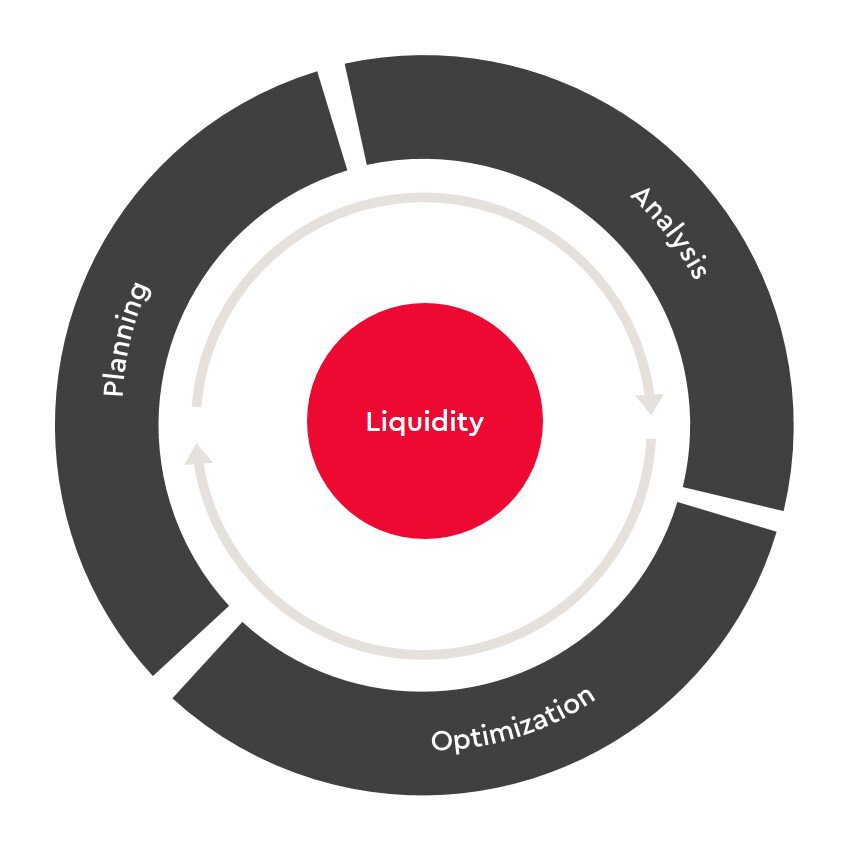

The schedule should include sufficient time for the analysis of liquidity planning. By comparing planned and actual figures, the quality of planning is constantly monitored and continuously improved. Plan-plan comparisons are used to identify trends and initiate countermeasures at an early stage. The forecast liquidity holdings and movements form the basis for risk analyses and simulation calculations. Minimum liquidity levels and dividend potentials can also be derived.

Due to the high level of detail and regular performance monitoring as part of the plan update, liquidity planning is the ideal starting point for deriving and monitoring measures to optimize liquidity, such as cash management, financial risk management and, in particular, working capital optimization. The broad anchoring of liquidity planning and the shared understanding of the forecast liquidity situation and liquidity drivers enable the effective coordination and implementation of optimization measures.

bstimmung und Umsetzung von Optimierungsmaßnahmen.

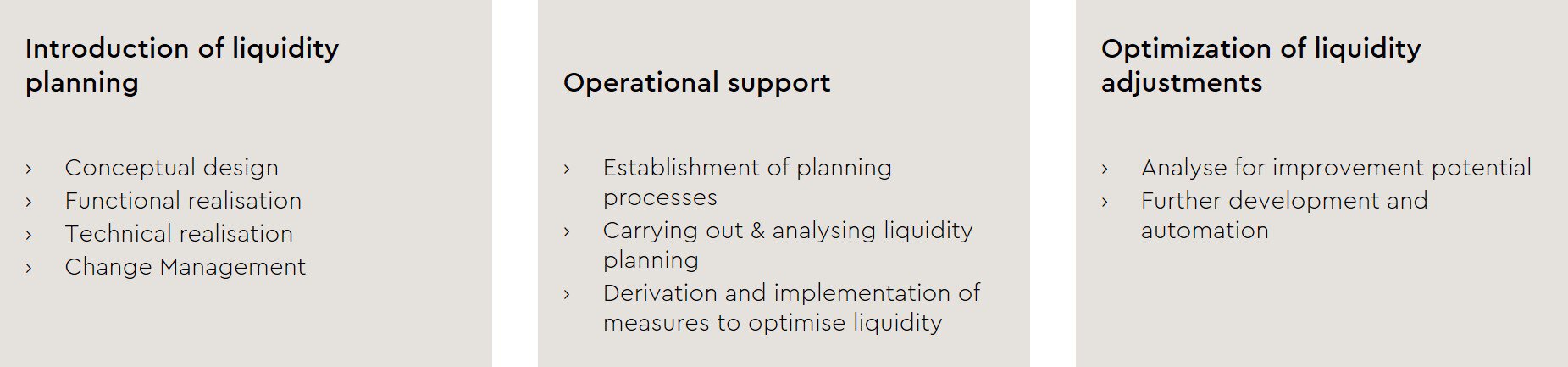

Our services in the area of liquidity planning and liquidity management:

Our experts at WTS Advisory provide comprehensive support in the introduction, implementation and optimization of liquidity planning, sustainable liquidity management and the introduction and use of system solutions.

Your contact to us

Do you have any questions about our services or WTS Advisory? We look forward to your message or your call!