Target Operating Model

Transformation as a challenge

Finance is a team sport. Only if everyone joins in, has a clear goal in mind and motivates each other to give their best on a daily basis we can make a difference. Let's not kid ourselves: "Here is our vision ... those who participate will be rewarded. And those who don't participate ... well, they can see where they end up" has had its day. Today, it takes a lot more to get everyone on board and get them excited about the organization's goals.

At WTS Digital Architects, we support our clients every day in managing the balancing act between tech and mindset shift. In doing so, we focus on value-adding end-to-end processes and resource-optimizing targets. Today we would like to share how transformation can succeed.

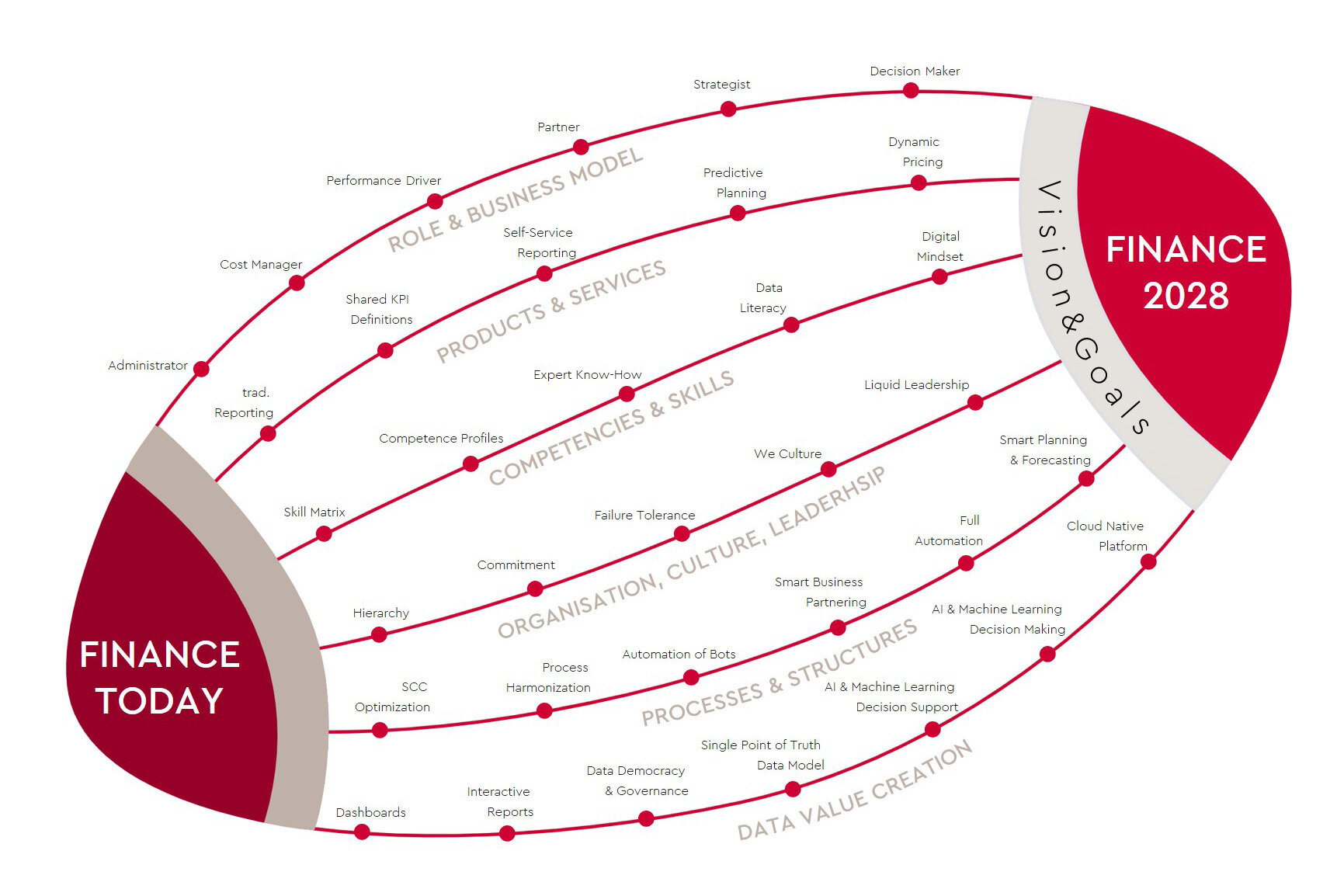

We have a formula that has proven itself repeatedly over many years: the WTS Finance Football! Our "secret sauce" when it comes to transformation. The recipe for success for anyone who wants to initiate something new. The ramp for "Let's go out there and do this!". The starting signal for a journey to a destination that everyone in the organization can identify with.

We'll show you how to get started here.

Target Operating Model as a solution - embrace the process!

Business as un-usual: the rate of technological progress in the field of finance has rarely been so high. New doors are opening all the time. Whether you like it or not, adaptation is becoming the standard and transformation a must-have in every finance department's toolbox. There are plenty of reasons for this:

- You want to make data-driven decisions to improve financial performance and are therefore considering introducing a new planning tool.

- You are on the verge of a merger, acquisition or process change and want to effectively manage changes within the finance function.

- You need to add more structure to your controlling in order to communicate key figures promptly to important stakeholders such as the board, management or external investors.

No matter what challenge you are facing: As soon as a big strategic idea is translated into operational plans, you need a functioning target operating model (TOM).

This usually specifies a target state that is defined in collaboration with all key stakeholders, includes a specific time frame and can be visualized on a multi-dimensional roadmap.

A solid model reduces complexity and boils down to a compelling vision that can be achieved in several feasible steps. In this way, the transformation becomes "snackable", i.e. it can be divided into small components that can also be scaled as required.

But here's the catch: a plan is only as good as its implementation. Not every theoretical construct can be implemented 1:1 in reality, no matter how well thought out it is. Because one of the most important components in the transformation process is and remains ... people!

Our experience shows us that it is easy to quickly fall back into old patterns after initial enthusiasm, to hit roadblocks when bringing different departments together ... and yes, even the best ideas don't always translate smoothly into day-to-day "doing".

Based on our many years of experience with transformative processes and expertise at the interface of management, technology and digital consulting, we have developed mechanisms that not only build a bridge between strategic vision and operational level, but also take the "human factor" into account.

The WTS approach: Finance Football

As digital architects, we think "tech-enabled" AND "human centered". We have made it our mission to design solutions that strike a balance between the two and see modern architectures as a lever for relieving your teams and enabling them to develop.

That is why we act "beyond digital". Because in our opinion, a successful transformation is first and foremost about a journey that generates added value for all stakeholders and encourages them to "stay on the ball" with enthusiasm and joy. In collaboration with you, we reduce your employees' fears and pain points and focus on the human factor.

We initiate and support transformation in the interests of the group and the common goal. In doing so, we not only look at processes, but also bring all decision-makers together, analyze competence profiles and moderate with a mixture of data and behavioral finance expertise.

We focus on designing holistic approaches. It doesn't work any other way. After all, a doctor also thinks about the "whole body" when treating you. Or to put it another way: it's not worth operating on a broken knee if your hip is completely crooked.

What we mean by this is that we have not just designed another target operating model, but have also understood that transformation must be thought of end-to-end, should allow a human perspective and processes cannot be viewed loosely from one another. But take a look for yourself:

We view transformation as a holistic ecosystem. What happens if you turn this adjusting screw a little ... does that change the plan? And what impact does it have if we scale here? This is precisely why we work with you to define measurable OKRs ("Objectives and Key Results") based on valid data. This allows you to climb into the cockpit yourself, make your own well-founded decisions and track progress in the performance dashboard.

Conclusion

We understand that you don't always have time to read long articles. That's why we would like to conclude with three important bullet points:

- Transformation means a tech and mindset shift and therefore requires holistic approaches that do not neglect the "human factor".

- Ideally, transformation should be considered end-to-end from the outset (keyword: data value chain); processes must be viewed as interdependent success factors on the way to the goal.

- Avoid wasted opportunities: Define OKRs in order to achieve measurable success.

Are you interested in the topic of finance transformation? We have the expertise you need! Get in touch with our contacts to find out more about how WTS can support you in your transformation.

Your contact to us

Do you have any questions about our services or WTS Advisory? We look forward to your message or your call!