The new standard “IFRS 18 - Presentation and Disclosure in Financial Statements”: Future regulations on presentation and disclosures in IFRS financial statements are intended to increase transparency and comparability

IFRS 18 will affect all companies that prepare their financial statements in accordance with IFRS accounting standards, regardless of their industry. The new standard aims to increase the transparency and comparability of financial reporting. Precise requirements for the presentation and disclosure of financial information will improve the quality and consistency of reporting. Companies must comprehensively revise their reporting processes in order to meet the new requirements and fulfill stakeholder expectations.

Publication by the IASB in April 2024

The new standard IFRS 18 “Presentation and Disclosure in Financial Statements” was published by the IASB on April 9, 2024 and comes into force - subject to EU endorsement - for reporting periods from January 1, 2027 with a retrospective adjustment to the previous year. The introduction of this standard is in response to investor concerns regarding the comparability and transparency of reporting on the financial performance of companies. IFRS 18 will replace IAS 1 “Presentation of Financial Statements” in the future and aims to significantly improve the basic framework of IAS 1 through comprehensive additions and innovations to the regulations, particularly with regard to the structure and disclosure in IFRS financial statements. IFRS 18 will have an impact on all companies in all sectors that prepare their financial statements in accordance with IFRS accounting standards.

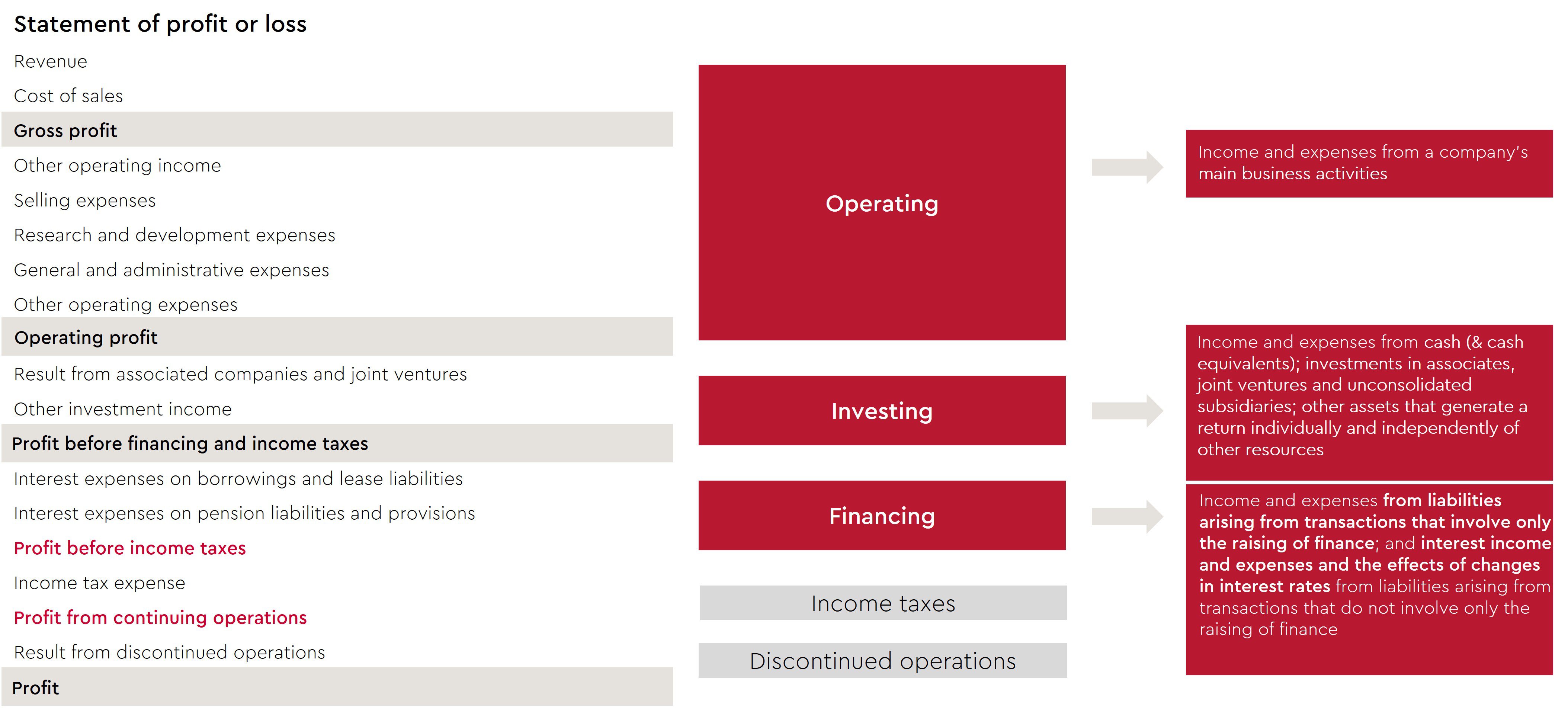

Changes to the income statement

In the future, two newly defined and mandatory subtotals will be added to the income statement: „Operating profit“ and „profit before financing and income taxes“. This will be accompanied by the introduction of three new categories for structuring income and expenses: The operating category (“operating”), the investing category (“investing”) and the financing category (“financing”):

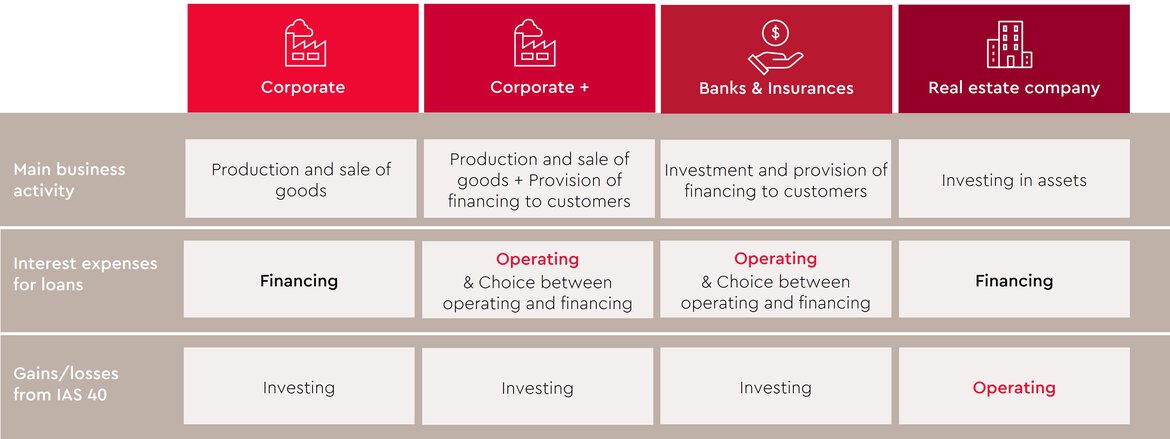

Special regulations for companies with a specific main business activity

The basic concept of the newly introduced categories in IFRS 18 is based on a traditional production or service company.

For companies with specific main business activities (including banks, insurance companies and companies that offer financing to customers), there are separate regulations regarding the allocation of expenses and income to the various categories so that expenses and income from operating activities are reported in operating profit or loss.

Effects of the type of main business activity on categories

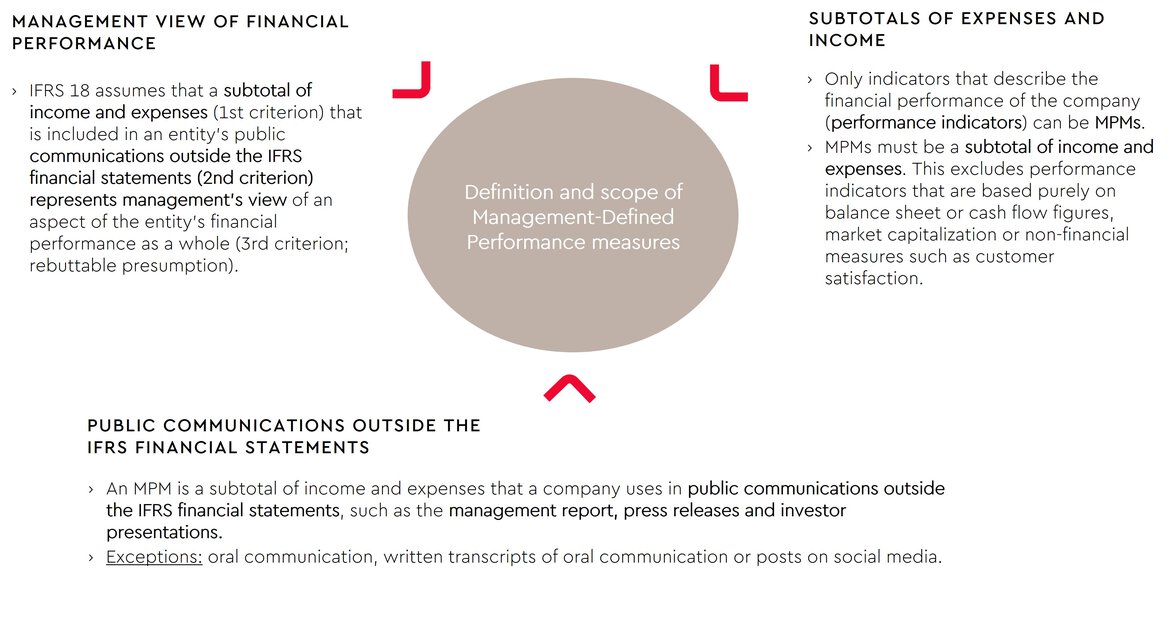

Extended notes disclosures – Management-Defined Performance Measures

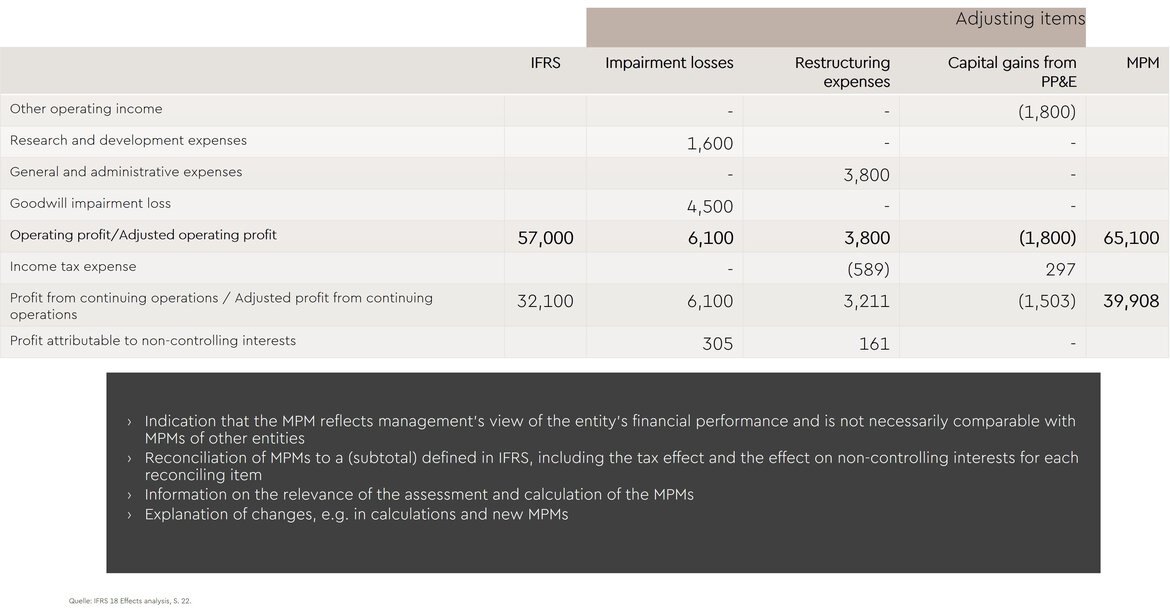

Among other things, the management-defined performance measures (MPMs) defined and publicly communicated by the company or its management must be disclosed in the notes. A reconciliation must be provided between an MPM and the most directly comparable subtotal listed in IFRS 18 or the total or subtotal required by IFRS accounting standards, including income tax and other effects. The reason for the assessment relevance of the MPMs must also be disclosed.

Definition and scope of management-defined performance measures

Separate notes on MPMs in the financial statements

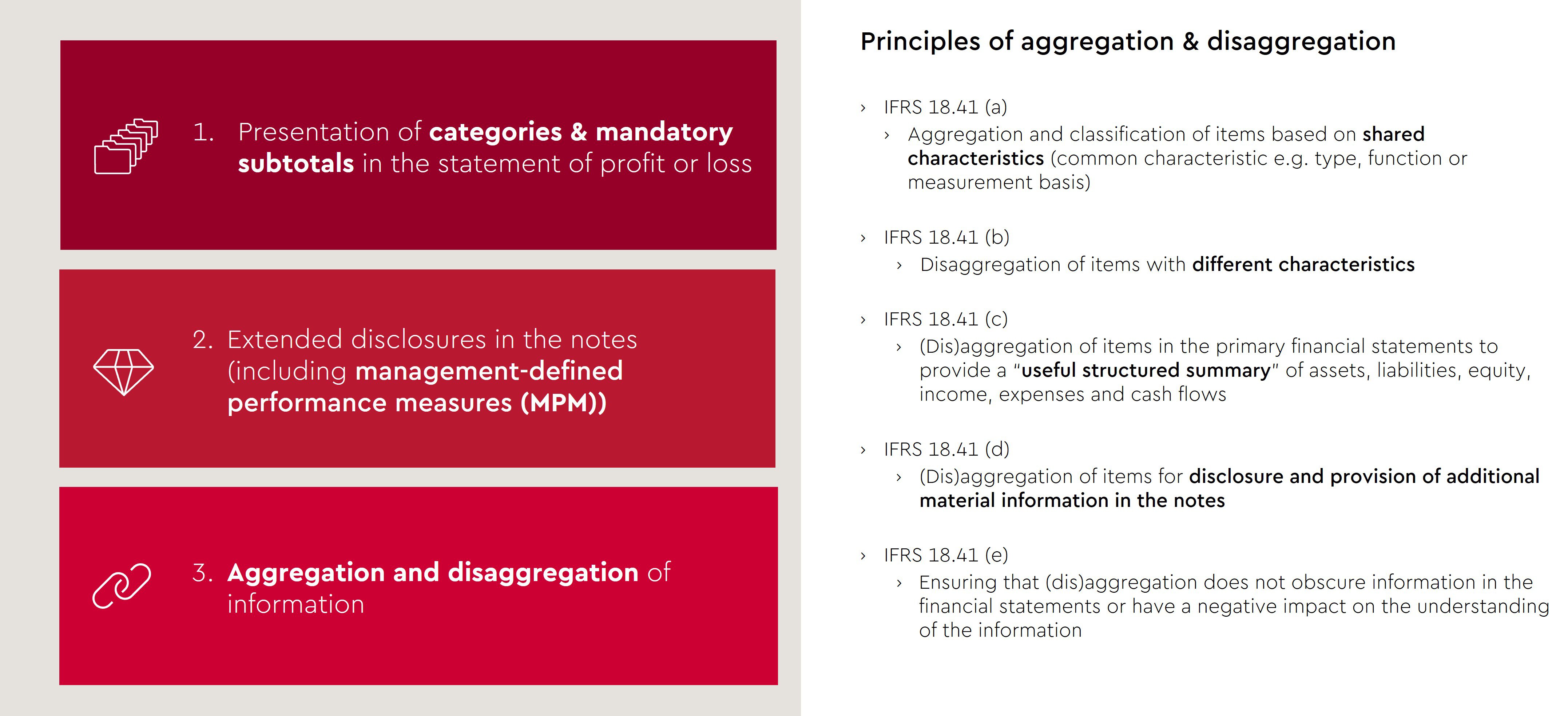

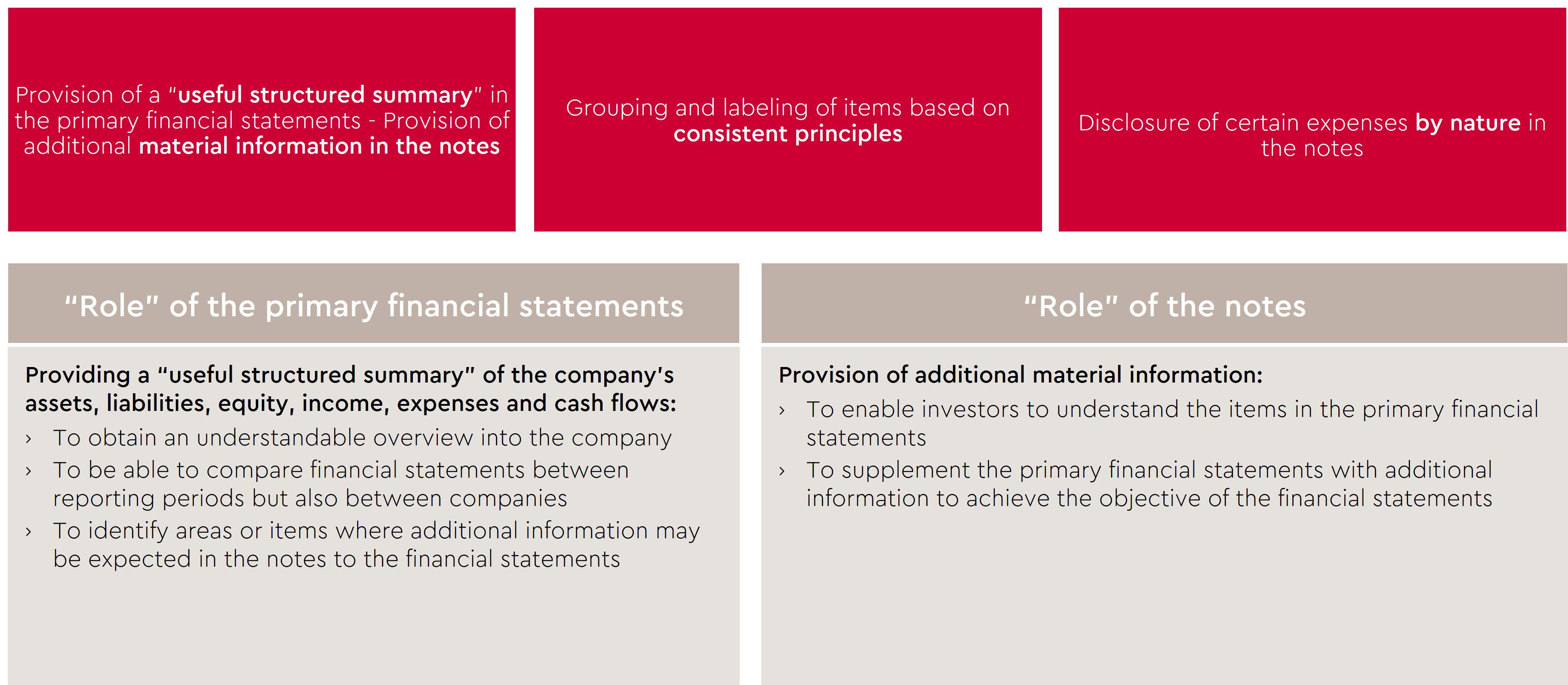

Improved guidance on aggregation & disaggregation of information

In the future, new principles-based aggregation and disaggregation guidelines for grouping information must be taken into account. This classification is based on common or non-common characteristics of items in the primary financial statements. This includes, among other things, newly defined “roles” for the primary financial statements and for the notes.

-

- In the future, the operating profit is to be reported as the starting point for cash flow from operating activities using the indirect method

- Furthermore, the options for the presentation of interest and dividend cash flows no longer apply. Dividends and interest paid are generally reported as cash flow from financing activities. Dividends and interest received are generally classified as cash flow from investing activities.

Among other things, goodwill is recognized as a new item in the balance sheet.

-

- IAS 34 was amended to the effect that companies are now required to publish information on management-defined performance measures in their interim financial statements.

- Some other changes, such as the mandatory disclosure of subtotals, also apply to condensed financial statements in interim reports.

Practical advice on implementation

The introduction of IFRS 18 will require extensive adjustments to the presentation and disclosure of financial data. In particular, the structuring of the income statement and the required disclosures on the disclosed MPMs may entail far-reaching changes and operational challenges. We therefore recommend an early analysis of the potential implications of IFRS 18 on reporting and relevant systems and processes in order to meet the new requirements on time. Get in touch with our team of experts today to develop a customized IFRS 18 implementation strategy and ensure your company is fully prepared.

Other topics that might interest you

Your contact to us

Do you have any questions about our services or WTS Advisory? We look forward to your message or your call!