Carve Out

Companies have always been exposed to external and internal influences that have caused reactions and changes within the company itself. Companies have always had to reinvent themselves. The reactions have been diverse. They ranged, for instance, from the hunt for economies of scale in the form of cross-sector industrial groups to concentration on core competencies. Currently, companies are facing a variety of transformations, in some cases entire industries.

Drivers include digitalization, disruptive business ideas and ecological significance, among others. These industry developments are leading to business units or product areas being put to the test and an active portfolio policy being pursued. The key aspect is that companies are striving for greater agility in terms of their organizational structure. They want to put themselves in a position to sell activities that are no longer relevant to them and in turn acquire or develop areas that are promising for the future.

Transaction capability is therefore an important success factor for today's companies. Carve-outs are extremely significant in this regard.

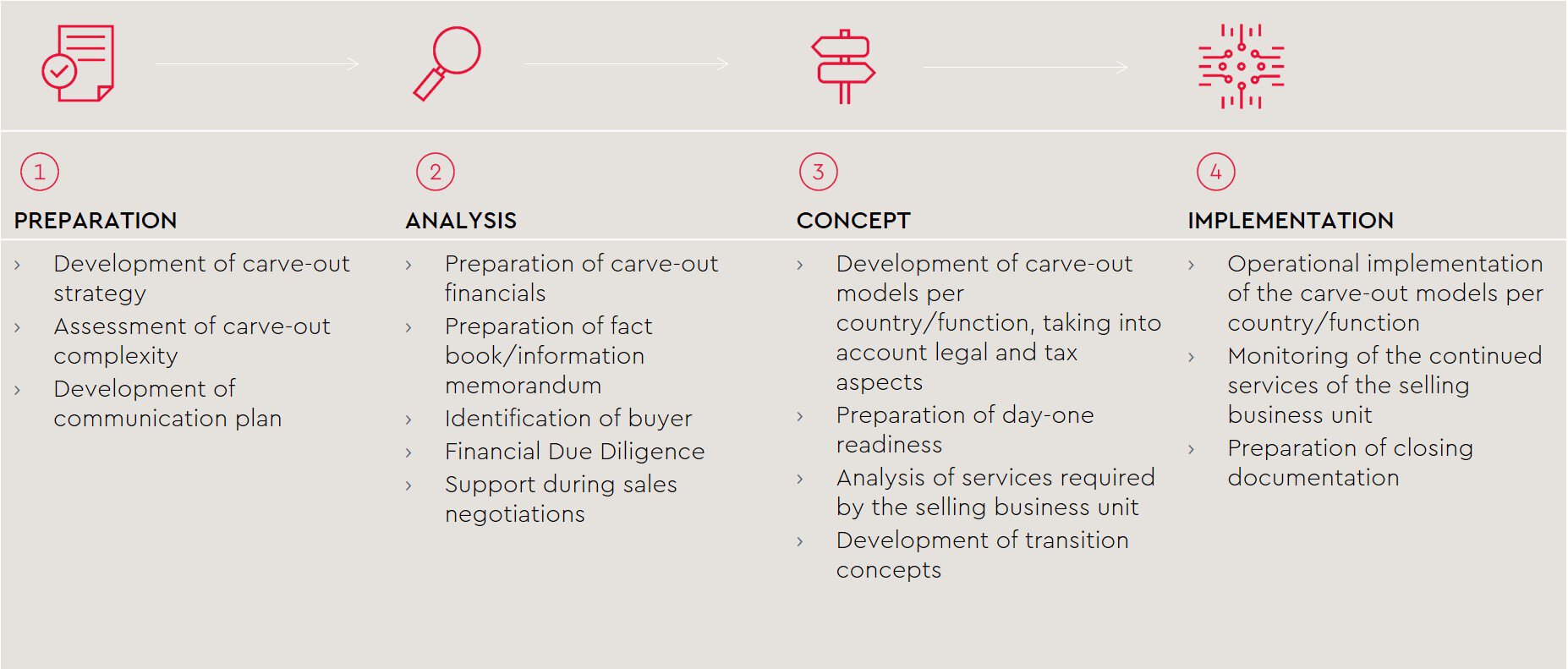

Following the strategic considerations, the business segments of a group under discussion are often separated organizationally as part of preparatory measures and thus prepared for a possible sale or reorganization. These preparatory measures should be carried out in a dedicated carve-out process in order to ensure a positive effect.

The tasks associated with a carve-out are interdisciplinary and present the people involved with exceptional challenges. In addition to the wide range of topics, this is also due to the fact that such projects usually have to be carried out in addition to day-to-day work and therefore often lead to resource shortages within the company. Furthermore, in the case of a stand-alone concept, the corporate functions have to be set up for the carve-out unit, which means that there is a duplication of functions in this area.

Complexity of carve-out processes

Carve-out processes are often extremely complex processes. The following factors contribute to the complexity:

- Preservation of value during the transaction process and optimal positioning in the context of a sale or IPO.

- Minimal disruption to business operations due to the commitment of resources.

- Ensuring the desired results such as meeting deadlines/costs and motivating employees through a structured approach and coordination of all carve-out activities.

-

Avoidance of compliance risks through timely communication

- Geringe Verfügbarkeit von Finanzdaten

- Bridging resource bottlenecks of the prospective buyer/partner

Carve Out Financials

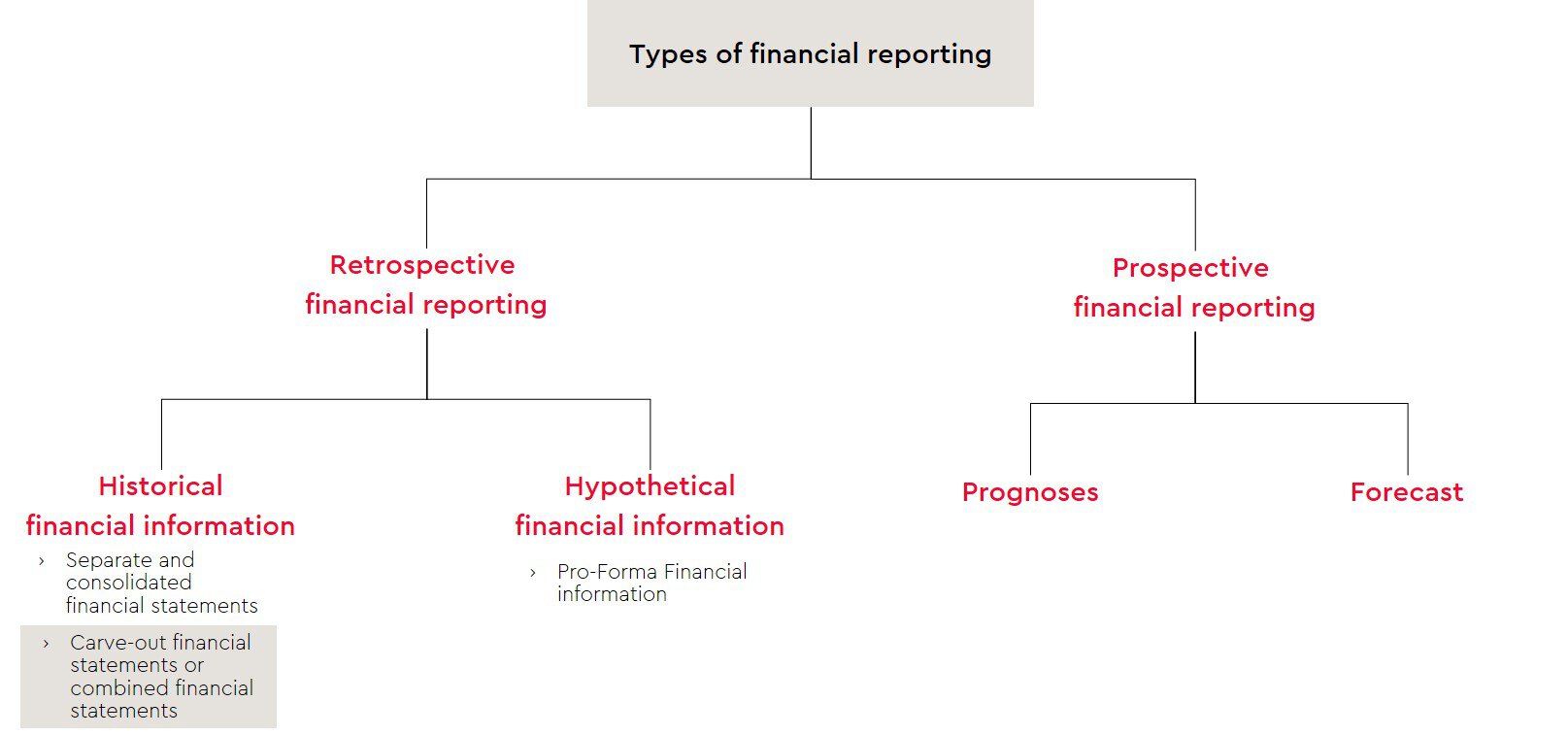

Carve-out financial statements are initially historical financial information, similar to individual and consolidated financial statements. This indicates that carve-out financial statements reflect transactions or business transactions that actually took place at a certain point in time in a certain period of time in the past. Except in the case of a carve-out relating to only one company, carve-outs generally belong to the group of "combined" financial statements. Combined financial statements in the narrower sense are financial statements in which only legally independent companies are combined. In practice, however, it is often the case that a sub-unit is combined with one or more sub-units and/or one or more legal entities (combined financial statements in the broader sense). This means that a highly integrated business unit can neither be presented in a subgroup nor in separate financial statements and needs to be transferred to a separate subgroup. Such integrated business units typically extend beyond company law boundaries, whether with bundled holding functions or with mixed-use production or sales locations.

Carve-outs often take place in an international context and should therefore be prepared in accordance with IFRS. However, there are no specific regulations for combined financial statements in IFRS, which creates corresponding leeway in the preparation. The same applies in accordance with HGB.

As part of the carve-out process, we support you conceptually and with the implementation and preparation of carve-out financial statements. We also assist you with the preparation of balance sheets in accordance with § 17 UmwG. We ensure that the carve-out financial statements contribute successfully to the carve-out in coordination with you and the overall process.

Successfully supporting carve-out processes

WTS Advisory supports you throughout the entire process, ranging from strategic considerations to the implementation of the carve-out. Our long-standing experience in supporting carve-outs of different sizes and from different industries with an interdisciplinary team ensures success. Based on the requirements of your carve-out transaction, WTS Advisory offers a service package tailored to your needs.

The benefits you receive from our support are numerous and include in particular: Operational support in all stages; optimization of the sales result; conservation of own resources to ensure that the day-to-day business is not impaired; significantly lower project costs due to a structured and coordinated approach; avoidance of unnecessary follow-up costs; selective support or supervision of the entire process; smooth start of the operational business.

Contact persons

Please do not hesitate to contact us if you are interested or have any questions.

Other services that might interest you

Your contact to us

Do you have any questions about our services or WTS Advisory? We look forward to your message or your call!