Combined Financial Statements & Carve Out

There may be a need to prepare combined financial statements or carve-out financial statements on various occasions.

For example, when preparing a prospectus for the public offering of securities, it is required that investors are able to make an informed assessment of the issuer’s assets and liabilities, financial position, profits and losses and future prospects.

In the case of issuers with a complex financial history, the issuer’s historical financial information may not cover all of its business activities. This is the case, for example, if the issuer has made a significant acquisition that is not yet reflected in its financial statements or if the issuer is a newly registered holding company. In such cases, the issuer’s business activities are wholly or partly handled by another company during the period for which it is required to provide historical financial information.

In the case of companies with a complex financial history (Regulation EC No. 809/2004, Article 4a), the prospectus must therefore be supplemented by certain information, such as combined financial statements, when it is prepared. Additional occasions for the preparation of combined financial statements or carve-out financial statements may be corporate transactions or restructuring.

Combined Financial Statements

Combined financial statements constitute financial information of different legal entities that do not form a group as defined by IFRS, but are generally managed by the same persons under common control or management.

Carve Out Financial Statements

A carve-out is the spin-off, spin-out or divestiture of all or parts of the assets to an acquiring legal entity. Particular challenges arise from the fact that the assets to be transferred are usually not listed as self-contained units in financial reporting or internal reporting and are generally dependent on the support of the owner/company (e.g. ERP systems).

We Prepare Combined Financial Statements and Carve-out Financial Statements for You

We accompany our clients from the preparation phase (development of carve-out strategy and communication plan) through analysis/data preparation (determination of reliable, meaningful financial information) and negotiation (preparation of fact book/information memorandum) as well as the design of the target structure (definition of carve-out models, day one readiness) to implementation.

Often, companies do not have sufficient accounting resources to be able to prepare complex combined or carve-out financial statements in addition to the regular financial statements that have to be prepared. Therefore, we will support you in the preparation of the necessary financial information and financial statements.

Based on the objectives, we jointly define the requirements for the financial statements to be prepared and a corresponding strategy. The starting point is the identification or differentiation of the affected products and services, assets and liabilities as well as the assigned employees. The provisional as-is financial statements will then be prepared on this basis.

Our proven process, which has been adopted by numerous renowned references, ensures a fast, stable, practicable and audit-proof preparation of the financial statements.

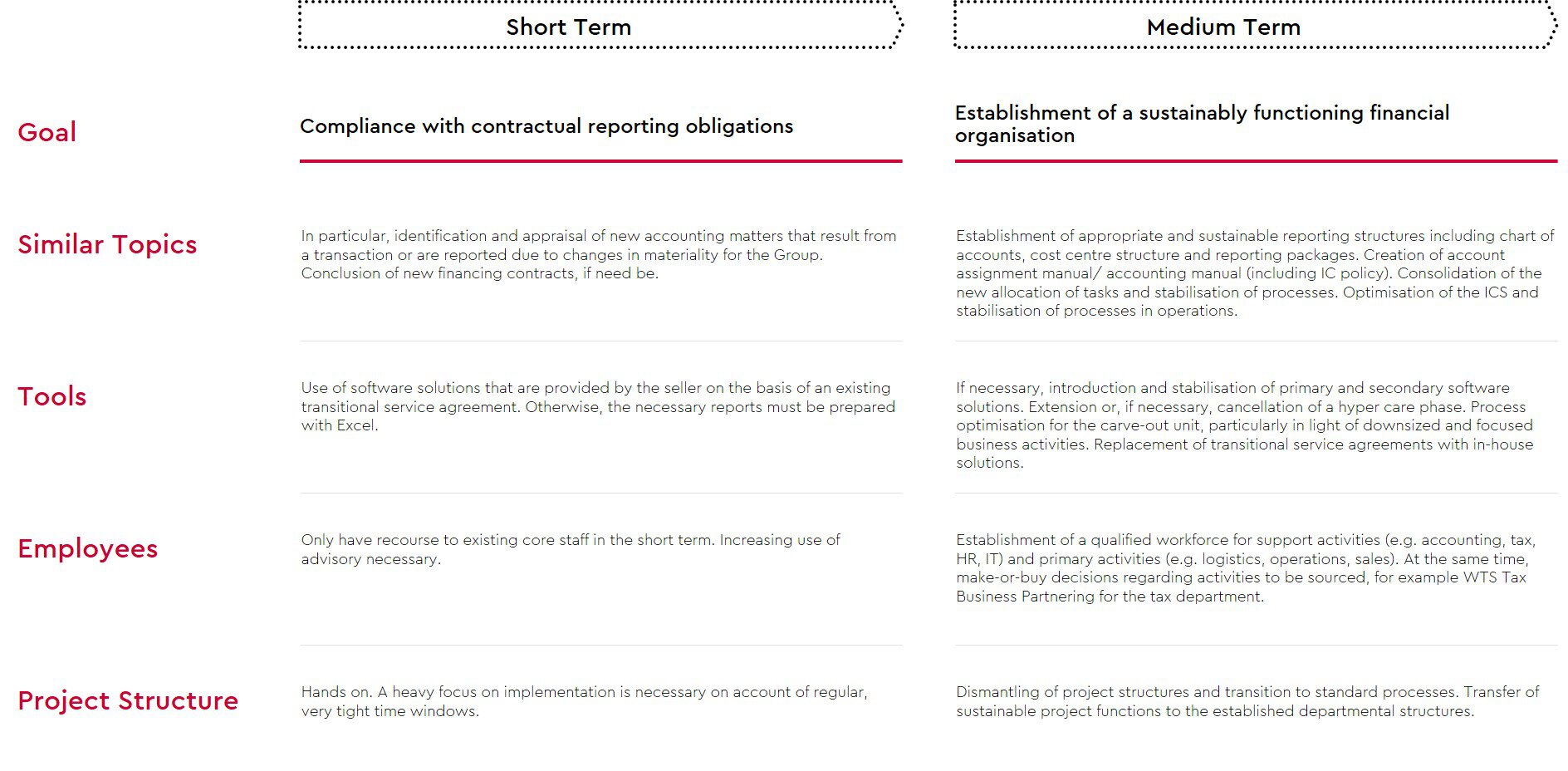

If you are interested or have any questions, please contact us. Please also refer to our services in the Finance Optimization competence area for the establishment of a functioning financial organization.

Your contact to us

Do you have any questions about our services or WTS Advisory? We look forward to your message or your call!