Audit Methods of German Financial Reporting Enforcement Panel (FREP) or CSSF

The German Financial Reporting Enforcement Panel (FREP; Deutsche Prüfstelle für Rechnungslegung, DPR) audits the consolidated and annual financial statements and the management reports of capital-market-oriented companies on a random basis, on account of events or at the request of the Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht, BaFin). In Luxembourg, the Commission de Surveillance du Secteur Financier (CSSF) handles the relevant audits.

Error findings from the audit procedures can lead to negative capital market reactions, loss of reputation of the persons responsible, loss of confidence and an increase in the frequency of audits in the future.

Usually there is little time between the initiation of the audit and the first deadline set for answering the questions asked. Furthermore, the audit procedures generally lead to a considerable additional burden on the already fully utilized employees in accounting.

Therefore, the preparation of high-quality financial statements with few weaknesses is always recommended. This also includes the prompt preparation of self-explanatory documentation that can withstand an enforcement procedure.

The appropriate, risk-oriented prioritization of documentation during the preparation of financial statements should play an important role. This prevents certain topics from being addressed several times and ensures that the central aspects were already sufficiently highlighted during the preparation of the financial statements.

Questions that are likely to arise in the audit process on these topics can then be answered regularly without extensive work. In particular, the already scarce time can be used for questions not anticipated in advance.

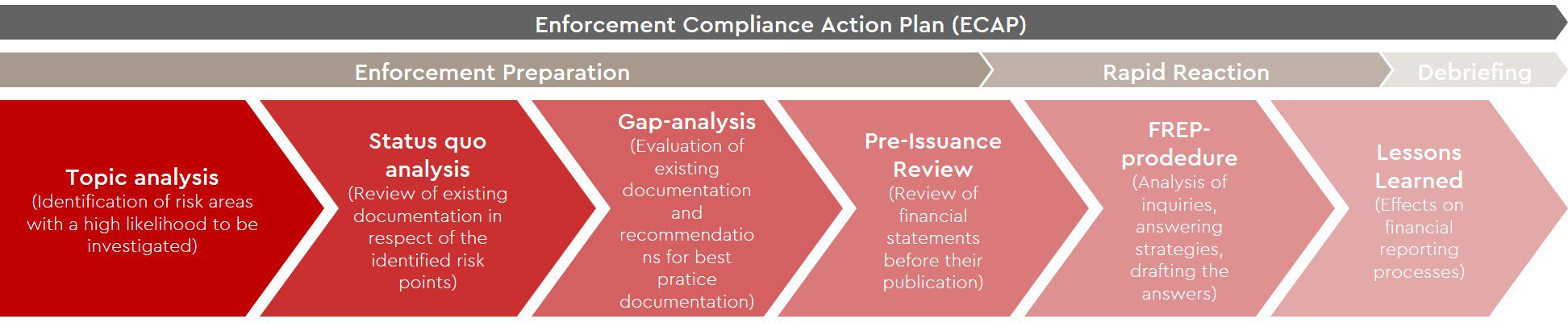

Enforcement Compliance Action Plan

Our proven Enforcement Compliance Action Plan and experienced staff let us accompany you at all times – before, during and after an enforcement procedure – when dealing with the German Financial Reporting Enforcement Panel (DPR) and the CSSF.

In the scope of the topic analysis, we identify circumstances with an elevated enforcement risk based on the audit focus of the European Securities and Markets Authority (ESMA) and German Financial Reporting Enforcement Panel as well as the individual circumstances of your company.

The recording of the actual situation on the basis of existing documentation with regard to the risk positions is followed by an enforcement readiness map as part of the gap analysis with recommendations for additional documentation and argumentation.

A pre-issuance review is recommended before publishing your financial statements. Here you will find suggestions on how potential pitfalls and points of attack can be reduced.

We always recommend these first four steps for each financial statements report that could potentially become the subject of an enforcement procedure.

If an audit procedure is initiated, we will accompany you throughout the entire procedure. For this purpose, we will analyze, for example, the questions, develop answer strategies and prepare or support you in the creation of answer drafts.

Your Advantages

- Significant reduction in error detection through adequate preparation

- Fast and unproblematic resolution of the enforcement procedure

- Reduced workload for your employees by involving WTS Advisory in the preparation of the procedure and the answering of the question letters

- Ensuring an orderly procedure primarily controlled by you thanks to fast reaction capabilities

- More extensive support than independence would allow the statutory auditor in the preparation of documentation and advice

- Internal exculpation through Enforcement Compliance Action Plan and process documentation before audit committees and board members

- Independence from the statutory auditor and ensuring an external perspective

- Building trust through a professional and competent approach to the German Financial Reporting Enforcement Panel or CSSF

If you are interested or have any questions, please contact us.

Your contact to us

Do you have any questions about our services or WTS Advisory? We look forward to your message or your call!