Consulting for Statutory Auditor Invitations to Bid

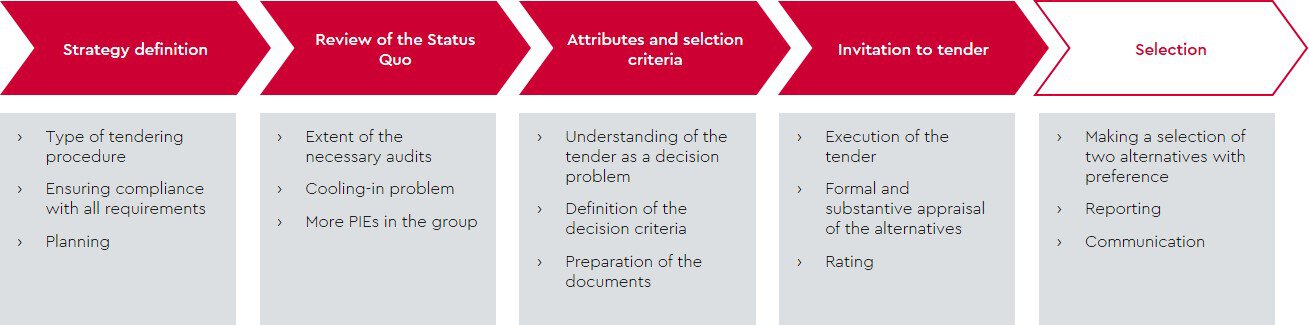

The entry into force of EU Regulation 537/2014 (EU Regulation) on specific requirements for the audit of public interest entities and its validity as of June 17, 2016, has established special regulations in particular for the appointment of statutory auditors.

Public interest entities are also required to change statutory auditors at regular intervals after a maximum period of ten years in the future. The maximum periods can be extended by another ten years if a public bidding procedure which complies with the specific procurement rules of the EU Regulation is carried out. In principle, the procurement rules apply to every invitation to bid unless an existing mandate is extended.

The overall responsibility for the bidding procedure lies with the audit committee or supervisory board. The latter shall make and be responsible for all material decisions and ensure compliance with the procedure.

The executive board and the technical departments support the audit committee in the handling of its responsibilities by, for example, preparing the bidding documents and selection criteria, evaluating the offers received and reporting on the selection procedure.

Selection of a Statutory Auditor

The selection of a statutory auditor is a classic decision-making problem. Once objectives (requirements) have been defined, measurable or evaluable attributes (selection criteria) shall be defined to measure the achievement of each objective. The principle of transparency and non-discrimination applies, as is otherwise the case throughout the procedure.

This causes challenges in terms of capacity and content for the audit committee of the supervisory board, the supervisory board itself, the executive board and technical departments.

WTS Advisory Will Support You in the Selection

WTS Advisory will support you with our experts in the planning and implementation as well as in the review of the statutory auditor invitation to bid. Our consultants are former auditors from major auditing firms and have extensive insights into the auditing firms, their products, audit processes and audit tools as well as into bid strategies and bid processes. In addition, our experts have already assisted a large number of companies with invitations to bid.

You Will Benefit from our Commitment at all Levels:

- We are a sparring partner and source of ideas for the audit committee. We accompany the bidding process as consultants and thus contribute an additional element of security, objectivity and transparency. We also reflect on your bidding process

- We reduce the workload for the executive board and the technical departments when it comes to preparing and operationally executing the invitation to bid. Among other things, we support you in the preparation of bidding documents and the analysis of the bids.

- Our experience and the use of proven procedures will shorten your preparation time and ensure an efficient process. For example, it is no longer necessary to identify completely new selection criteria, invent valuation models or go through the trouble of asking your peers for benchmark information.

- Early integration of WTS Advisory helps you to avoid errors that are difficult to fix later. For example, once the selection criteria have been established and communicated, the statutory auditors should also be assessed on the basis of those criteria.

- As former auditors, we know the contents that are hidden behind the respective bid texts and therefore clearly differentiate between the bids. Furthermore, we reveal the levers of pricing and show you the risks of future renegotiations. You will be well prepared for the price negotiations.

Our contact partners would be glad to speak with you personally!

Our Offer in the Area of Bidding Support

- PMO/Coordination Instance

In our most compact support package, we handle essential project management steps, the coordination of bidding plans and budgets as well as the coordination of milestones and results. - Internal Sparring Partner

We are internally active for you here, in the review, summary and evaluation of the bids, without directly or indirectly addressing the statutory auditor. If you wish, the auditor will not learn about our joint preparation and cooperation. Thus you can let the templates and documentation prepared by us as well as recommendations be included in the discussions as your own basis for decisions. You will benefit from a wide range of industry and market know-how and get to know the “insider tricks” of the audit. - Active Participation

Here we offer the contribution of our many years of experience in cooperation with statutory auditors, active participation in discussions such as the negotiation of the audit fee or the audit details (audit plan, team composition, etc.). - “Complete Package”

In our all-inclusive, no-worry package, we handle the entire process ourselves. For important decisions, we perfectly prepare the information for you, integrate it accordingly and make recommendations. In audit planning and fee negotiations, we get the most for you by thoroughly examining – as an independent third party – the bids and the applicants themselves, preparing an analysis on the basis of proven analysis tools and eliminating critical areas in your interest. In addition, we offer you an optimized audit plan interlinked with internal processes after the selection of the auditor, which ensures that the audit of the financial statements runs as smoothly as possible.

If you are interested or have any questions, please contact us.

Your contact to us

Do you have any questions about our services or WTS Advisory? We look forward to your message or your call!