CSR Directive Implementation Act: Non-financial Declaration for Companies

Non-financial Declaration Requirement for Companies

The announcement of the law to strengthen the non-financial reporting of companies in their company management reports and Group management reports (CSR Directive Implementation Act) of April 11, 2017, means that certain companies have to issue a non-financial declaration for fiscal years beginning after December 31, 2016 (Section 289b of the German Commercial Code (HGB), Section 315b of the Commercial Code). Capital-market-oriented companies, financial institutions and insurance companies are affected if they are regarded as large corporations in accordance with Section 267 (3) of the Commercial Code and employ more than 500 people. The implementation of the CSR Directive entails that many companies will already have to consider CSR reporting in 2017.

The non-financial declaration must be included in the management report in accordance with the new EU directive. Alternatively, a non-financial report may be drawn up. In any case, CSR reporting/sustainability reporting has been incorporated into commercial law.

Companies that meet the above criteria will be required to report on the following topics in accordance with the CSR Implementation Act in the future:

- Environmental issues

- Employee issues

- Social issues

- Respect for human rights

- Combating corruption and bribery

In addition to the concepts, i.e. the approach to central non-financial aspects and the most important objectives, it is also necessary to disclose the results of the concepts. For example, on the basis of selected performance indicators such as actual emissions or the use of hazardous chemicals or biocidal agents.

If the company does not have any concept for one or more issues or aspects, it shall clearly state the reasons for and explain this in the non-financial declaration. In most cases, companies implicitly have concepts at their disposal, even if these have not yet been formalized. In addition, hardly any companies will compromise their public image by not being able to demonstrate any concepts for CSR reporting obligations.

The CSR Directive also requires an explanation of the procedures for identifying, preventing and mitigating negative impacts of a company’s business activities (due diligence processes). In accordance with the CSR Implementation Act, it is also necessary to report on material risks that are associated with the company’s own business activities, the business relationships of the corporation, its products and services and are very likely to have or will have serious negative effects on these aspects. This means that the supply chain and, in principle, the lifecycles of the products must also be taken into consideration.

Finally, the lawmakers require disclosure of whether the company has used a framework to prepare the non-financial declaration. In addition to many other frameworks, the Global Reporting Initiative and the German Sustainability Code are ideal for implementing the CSR Directive.

Challenges in Preparing a Non-financial Declaration

- The non-financial declaration must be examined by the supervisory board – with the same intensity as the financial statements and the management report. The supervisory board only obtains sufficient assurance when reliable processes and controls have been implemented in connection with the non-financial declaration.

- Many companies do not yet have established processes for collecting the relevant data or they collect the data manually in a time-consuming manner.

- The responsible employees may not be as familiar with data collection and documentation as staff in accounting. The data is generally more susceptible to errors.

- Non-financial information is initially more susceptible to errors because reporting systems and controls differ from financial reporting systems, particularly in terms of process speed, quality, completeness and accuracy.

- Surveys within the supply chain require a certain amount of lead time.

- Documentation must be provided for the contents of the report, which also forms the basis for the audit by the supervisory board.

- Time aspects and resources also play a role. In most cases, the supervisory board expects to be able to report on the audit of the non-financial declaration at the meeting on the financial statements rather than, at the latest, four months after the reporting date.

- The initial and careful preparation of the non-financial declaration requires a structured approach and knowledge of sustainability reporting.

WTS Advisory Support in the Preparation of a Non-financial Declaration

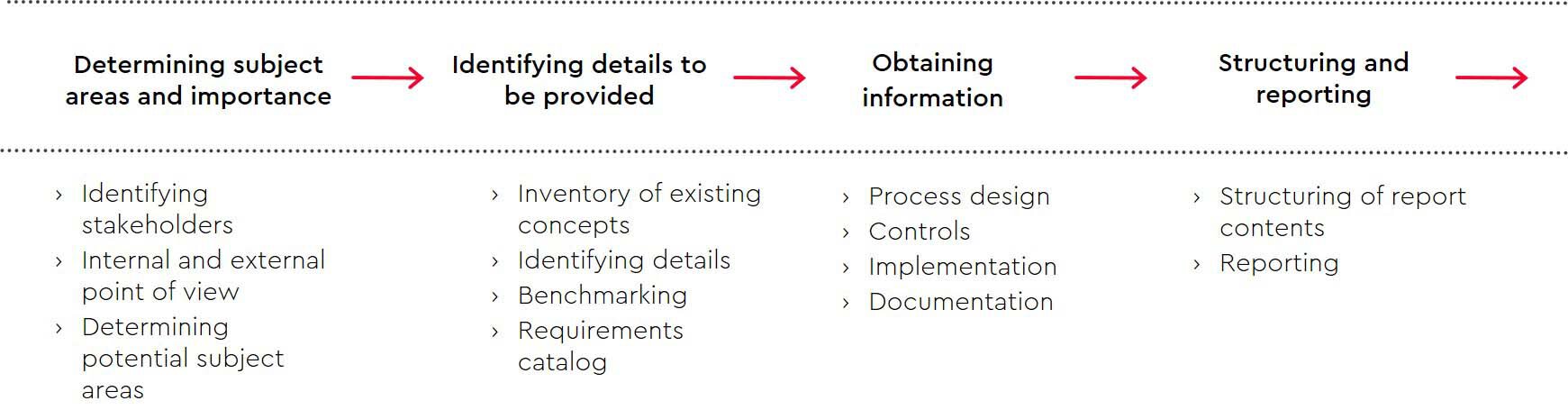

As experts for reporting processes, WTS Advisory will support you in the procedural implementation and the preparation of the non-financial declaration. You will find a simplified description of our integrated approach below.

If you are interested or have any questions, please contact us.

Your contact to us

Do you have any questions about our services or WTS Advisory? We look forward to your message or your call!