Finance Business Partnering

In today's dynamic business world, business partnering in finance and accounting is often key to a company's success. By working closely with operational units, we transform data into valuable insights that enable well-founded and forward-looking decisions. Our approach goes far beyond traditional outsourcing: we enable and support your financial experts to identify risks at an early stage and make targeted use of opportunities. Together, we handle operational challenges. Benefit from our expertise, draw on our professional network and make your finance function the strategic driver of your company's success.

Our Finance Business Partnering approach

WTS Advisory specializes in the rapid and objective identification of rationalization and optimization potential in the financial area of small and medium-sized companies. In the event of capacity bottlenecks in accounting, our experts offer comprehensive support and take on both temporary and permanent central tasks, including financial accounting and the preparation of monthly and annual financial statements. With a pragmatic and targeted approach, we ensure that your accounting and financial processes run smoothly and efficiently. This allows you to concentrate fully on your core business while we ensure the reliable handling of your accounting tasks.

Your challenges

Companies often encounter complex situations in accounting such as

- Lack of internal resources to handle bookkeeping, financial statement preparation and controlling efficiently and competently

- Dissatisfaction with the cost-performance ratio of financial accounting or accounting software

- Setting up or expanding controlling, cost accounting or corporate planning in line with requirements

- Need to optimize financial processes for potential acquirers or partners

- Acquisition of a company or parts of a company that need to be quickly integrated into finance and accounting

- Need to reliably manage the accounting of franchisees or associated companies

Our services

The aforementioned challenges generally require fast and targeted solutions such as

- Identification of optimization potential and/or outsourcing opportunities in financial accounting

- Provision of external experts to temporarily or permanently take over accounting functions including financial accounting, monthly reporting and annual financial statements

- Support in setting up and expanding controlling, cost accounting and implementing new IT systems

- Fast and cost-effective implementation of local accounting structures for company takeovers

- Reliable control of accounting processes with standardized reports

in order to efficiently design financial processes and make well-founded strategic decisions.

Finance Business Partnering in special situations

Even in special situations such as a carve-out, the implementation of a new ERP system or restructurings, the requirements for financial accounting as well as for the preparation of monthly/quarterly reporting and annual/consolidated financial statements in accordance with HGB and/or IFRS must be met in full and on time. This also includes taking care of and supporting the auditors throughout the entire audit process. If in special situations the existing accounting capacities are no longer available to the necessary extent, companies can often bridge these times with the help of external support, i.e., by means of a service provider specialized for this purpose.

Your challenges

Companies are often exposed to special situations in the area of finance, such as:

- Purchase/sale, carve-out projects, restructurings (e.g. relocations)

- ERP system change

- Changes in the finance function (e.g. outsourcing, insourcing), staff turnover (e.g. maternity leave, demographic trends)

- Expansion of reporting requirements

- Lack of know-how (for example for consolidation/group financial statements)

- Bottlenecks in accounting caused by other factors

In these special situations, the previous accounting and reporting capacities are only available to a limited extent or are no longer available at all, and it takes some time to overcome the resource bottlenecks. Too much time usually elapses before a new accounting and reporting unit is established and fully functional with well-established processes.

Our services

We flexibly take over the accounting and reporting function (or parts thereof) on an interim or permanent basis. This includes the following services:

- Carrying out day-to-day accounting and preparing financial statements and reportings (monthly, quarterly, annual and, if applicable, consolidated financial statements) in accordance with HGB and/or IFRS

- Execution of supporting controlling activities based on the company-specific KPIs as well as the

- Planning, control and monitoring of the respective closing processes and

- Supervision of the audit

Furthermore, we also perform ICS activities such as internal controls in accordance with your requirements. We work on the client's system, for example with SAP. In doing so, we use experienced employees, many of whom have both a consulting and an industry background. In addition, we also take on project management for monthly, quarterly and annual financial statements using agile methods, if required.

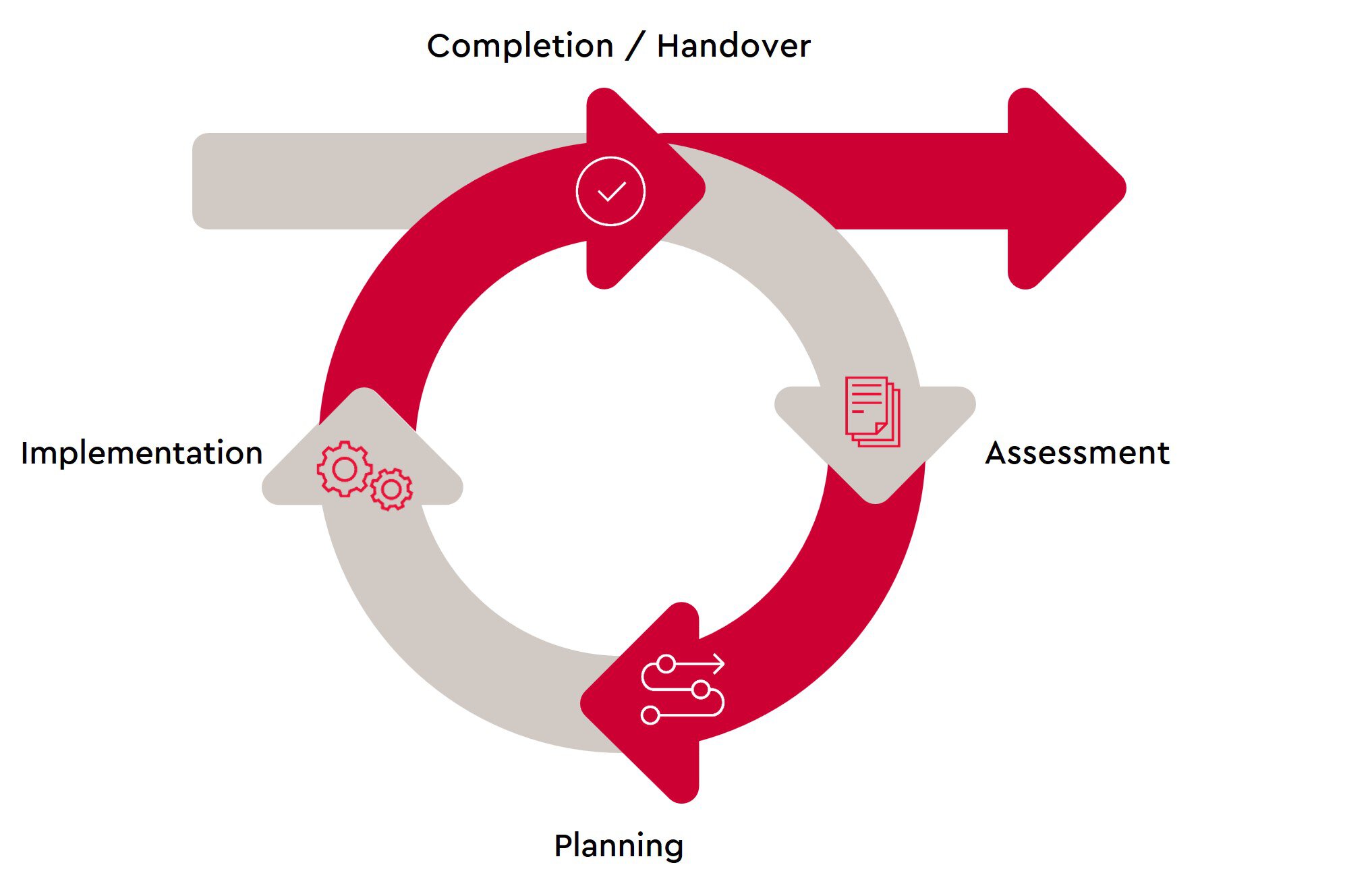

Our approach

Agile project & program management: We use tailored tools to suit your infrastructure and specific project requirements.

Finance business partnering for governance systems

The staffing and administration of governance systems can be a challenge for both medium-sized and large international companies. Increasing regulatory requirements require the appropriate establishment of functions such as risk management, compliance, the internal control system (ICS) or internal auditing. On the other hand, cost pressure is constantly increasing.

Our experts provide flexible support for all activities and ongoing processes in the areas concerned, from the implementation of a governance system to ongoing operations and reporting to the relevant supervisory bodies. In this context, we can for instance provide you with an ICS coordinator, compliance officer or the entire internal audit department. We can tailor the scope of tasks to your specific requirements.

In addition, as part of our finance business partnering, you can also access experts from the Reporting & Regulatory, Digital Finance and Deal Advisory departments at any time. Contact us to make your internal control systems future-proof and efficient.

Our services

Outsourcing of your internal audit

We take over your entire audit function (or parts of it) on an interim or permanent basis. This includes the following services:

- - Risk-based audit planning

- - Planning and execution of individual audits (remote and on-site)

- - Reporting of audit results, in particular findings and recommendations for action

- - Contact person for supervisory bodies and auditors

Assignment of an ICS coordinator

We manage your internal control system on an interim or permanent basis. This includes the following services:

- - ICS scoping for the adequate design of the ICS

- - Implementation or optimization of the ICS

- - Operational management of the ICS process and control testing to ensure appropriateness and effectiveness

- - Reporting on the ICS, in particular on its effectiveness

- - Contact person for supervisory bodies and auditors

Assignment of a compliance officer

We support your compliance management system on an interim or permanent basis. This includes the following services:

- - Conducting the compliance risk analysis

- - Setting up and developing the compliance program (guidelines, processes/controls and training)

- - Conducting compliance training

- - Operating the whistleblower system

- - Assessing the appropriateness and effectiveness of the CMS

- - Reporting on the CMS

- - Contact person for supervisory bodies and auditors

Assignment of a risk manager

We provide an experienced risk manager to administer your risk management system on an interim or permanent basis. This includes the following business partnering services:

- - Development and optimization of an efficient RMS

- - Operational implementation of the risk inventory including identification and assessment of existing risks

- - Reporting on corporate risks, preparation of the opportunity and risk report

- - Assessment of the appropriateness and effectiveness of the RMS

- - Contact person for risk reporters, supervisory bodies and auditors

We take over your entire audit function (or parts of it) on an interim or permanent basis. This includes the following services:

- - Risk-based audit planning

- - Planning and execution of individual audits (remote and on-site)

- - Reporting of audit results, in particular findings and recommendations for action

- - Contact person for supervisory bodies and auditors

We manage your internal control system on an interim or permanent basis. This includes the following services:

- - ICS scoping for the adequate design of the ICS

- - Implementation or optimization of the ICS

- - Operational management of the ICS process and control testing to ensure appropriateness and effectiveness

- - Reporting on the ICS, in particular on its effectiveness

- - Contact person for supervisory bodies and auditors

We support your compliance management system on an interim or permanent basis. This includes the following services:

- - Conducting the compliance risk analysis

- - Setting up and developing the compliance program (guidelines, processes/controls and training)

- - Conducting compliance training

- - Operating the whistleblower system

- - Assessing the appropriateness and effectiveness of the CMS

- - Reporting on the CMS

- - Contact person for supervisory bodies and auditors

We provide an experienced risk manager to administer your risk management system on an interim or permanent basis. This includes the following business partnering services:

- - Development and optimization of an efficient RMS

- - Operational implementation of the risk inventory including identification and assessment of existing risks

- - Reporting on corporate risks, preparation of the opportunity and risk report

- - Assessment of the appropriateness and effectiveness of the RMS

- - Contact person for risk reporters, supervisory bodies and auditors

Further topics you could be interested in

Your contact to us

Do you have any questions about our services or WTS Advisory? We look forward to your message or your call!