GRC - Environmental Social Governance

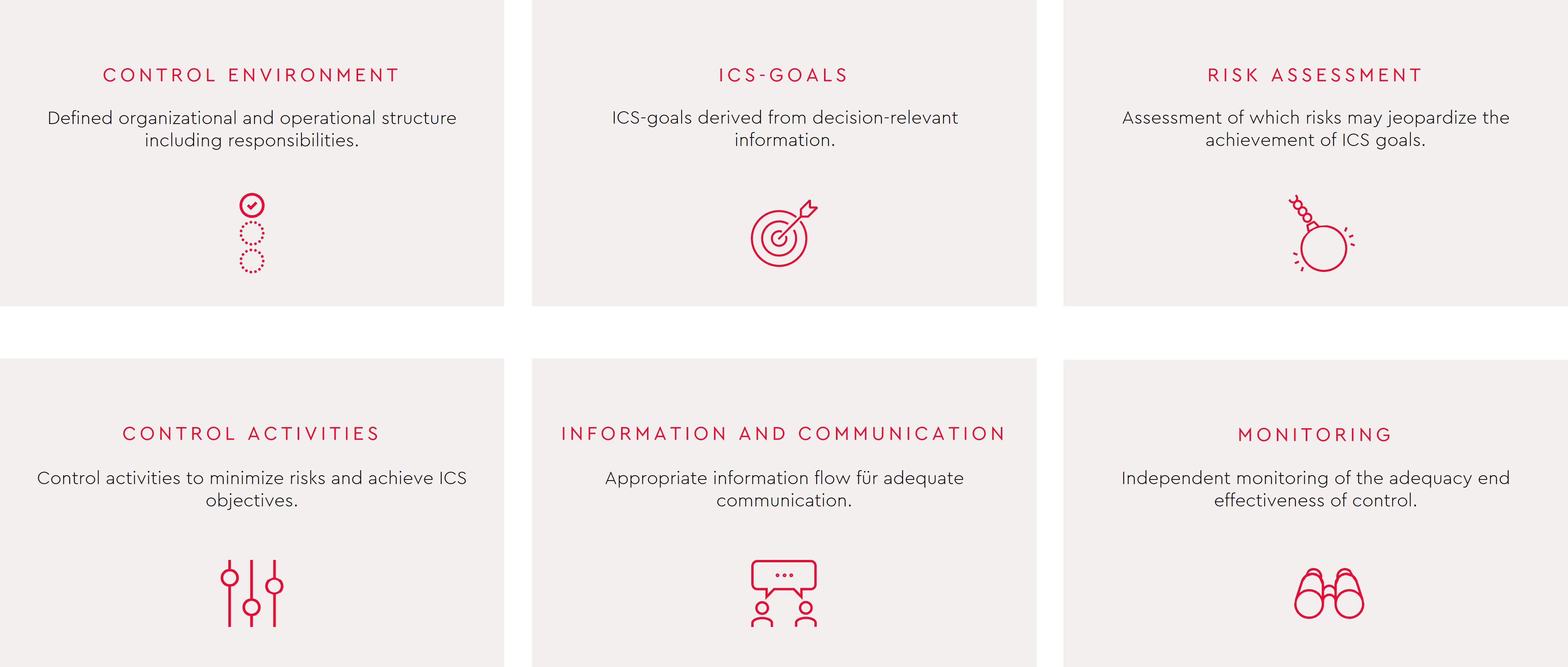

ESG - Internal control system

ESG-related key performance indicators (KPIs) are also becoming increasingly important as part of the growing requirements in the area of environmental, social and governance (ESG for short). These are not only important for sustainable corporate management, but also for external financial reporting. The growing interest of important stakeholders is also increasing the pressure on the quality of the data on which the KPIs are based, and not just for key performance indicators relevant to management. The KPIs and therefore also the data collection processes are also coming more into the focus of auditors. Data quality and data availability represent a considerable challenge for many of our clients. Our ESG consulting addresses these issues and supports you with a structured approach.

An appropriate and effective internal control system (ICS) can help you to ensure adequate data quality that also meets the requirements of the auditors. In addition, the processes for data collection can be designed transparently and efficiently. It is already apparent today that the traditional scope of financial internal control systems is being expanded to include ESG.

Our many years of experience in industry, IT and consulting ensure tried-and-tested solutions from project planning to ongoing operation - in a combination tailored to your individual needs. When designing ESG-related ICS components, we are guided by IDW PS 982 and can draw on concentrated process knowledge from our WTS process house to efficiently design the implementation of your ESG ICS. As part of our ESG consulting, you therefore benefit directly from our interdisciplinary team approach and the experience of other ESG services of WTS Advisory.

We are a strong partner for the design and optimization of your ESG-related ICS:

- Efficient and pragmatic approaches for the design and implementation of ICS components

- Transparent process analysis and evaluation to ensure appropriate risk identification in the ESG processes

- Focused control design

- Efficient monitoring through flexible reports & dashboards

- Reduced effort through automated workflows

- Support in coordinating with your auditor

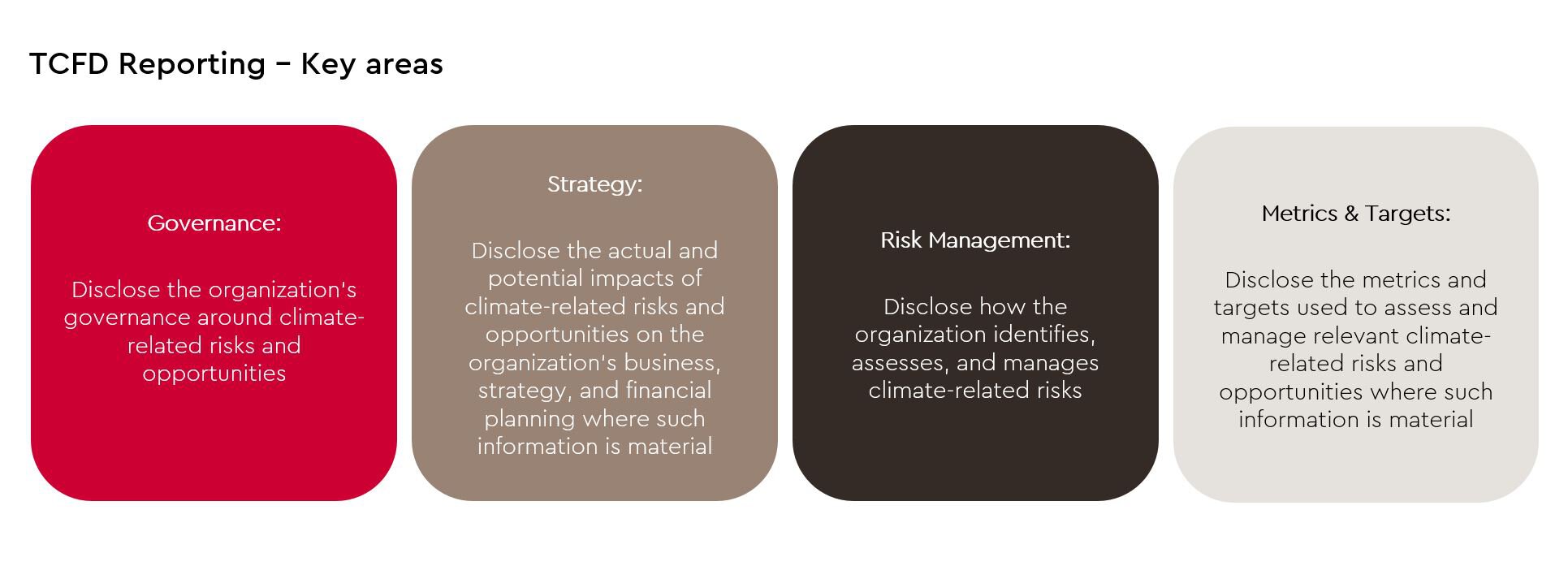

Assessment of sustainability risks and climate risks in particular

When developing the standards for sustainable financial reporting, various standard setters emphasized the need for transparent presentation of sustainability-related and, in particular, climate-related risks and opportunities. The CSRD is based on the framework of the Task Force for Climate-related Financial Disclosure (TCFD). This provides, for example, recommendations in relation to the reporting of climate-related risks and opportunities (outside-in perspective), which are intended to improve the information basis for investment decisions.

Together with us, you can prepare your risk management for the new requirements:

- Analysis and optimization of the risk management organization and methods to ensure that changing requirements are anchored in the organization accordingly

- Supporting the identification and assessment of your sustainability and climate-related risks and opportunities, including the required scenario analysis

- Development of control measures for identified risks and opportunities and support for effective implementation

- Support in the preparation of risk reporting

- Implementation of communication and training measures to raise employee awareness of sustainability risks

- Efficient monitoring through flexible reports & dashboards

- Support in coordinating with your auditor

If you are interested and have any questions, please do not hesitate to contact us.

Your contact to us

Do you have any questions about our services or WTS Advisory? We look forward to your message or your call!