Debt Advisory

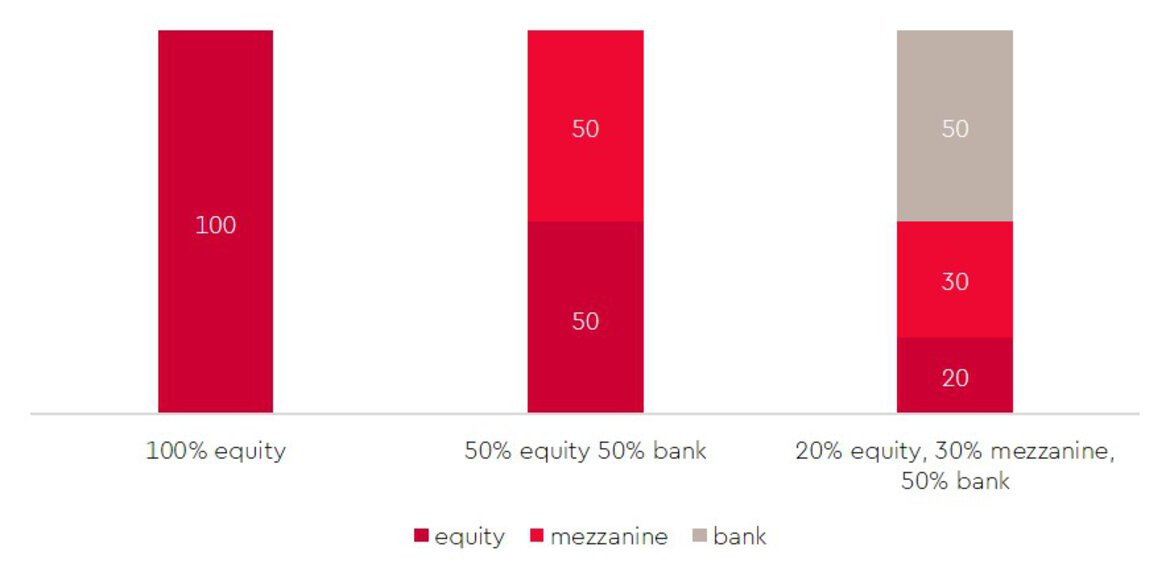

As part of the M&A strategy, in addition to the search for the right target company or. Buyer always also the question of financing the transaction. Depending on the industry, business model and risk assessment of the investors or owners respectively. the management can observe a range from pure equity financing to a maximum use of debt capital. On the basis of these considerations regarding the M&A and financing strategy, it is necessary to analyze the basic financing options. Here, it depends on the creditworthiness, the cash flow and thus the capital service capability of the acquiring company, the company to be acquired and, for example, a special purpose vehicle for the acquisition of the target company. Depending on the amount of the leveraged share of the purchase price, alternative lenders such as mezzanine or debt funds are also possible in addition to traditional banks. In general, the degree of complexity and timing of acquisition financing should not be underestimated. However, the effort is worthwhile if the optimal financing structure in terms of risk or return is at the end and a deal that initially does not seem to be financed could be financed.

Exemplary financing structures for M&A transactions:

Buy-side financing expands strategic options in M&A transactions

Every company faces the challenge of making optimal use of its available equity capital. Particularly in the case of a capital-intensive decision such as the acquisition of another company, the question arises as to how much equity capital can be used. and where the optimal leverage (leverage) and thus the optimal opportunity-risk ratio of a transaction lies. In particular, it should be noted that the acquisition structure and financing structure go hand in hand and should be coordinated from the outset. In the case of a majority shareholding and associated consolidation, for example, financing opportunities arise on the basis of the creditworthiness of the company to be acquired.

Our approach to financing buy-side activities

From our point of view, it is particularly important that the aspect of financing is included in the M&A activities from the outset in order to be able to optimally define the search criteria. Accordingly, we accompany buy-side financing throughout the entire process:

- Development of the optimal financing structure (equity, debt, mezzanine, vendor loans, etc.)

- Comparison of whether the planned acquisition structure and the financing structure go hand in hand

- Preparation of documents for contacting banks / debt funds

- Support of discussions with banks/debt funds

- Optimal arrangement of a so-called hunting line with banks / debt funds in order to be able to implement the acquisition strategy flexibly and quickly

Our overarching goal in all these activities is to increase the probability of implementation of transactions for our clients and to optimally generate advantages in negotiations with sellers through an advantage in the speed of implementation.

Sell-side financing optimizes the sales process and expands the buyer spectrum

Basically, compared to buy-side financing, we are merely moving to the other side of the negotiating table. Wouldn’t it be optimal for a company buyer not to have to worry about financing the purchase price because the seller brings a financing proposal to his bank’s negotiating table? This financing approach of the so-called Stapled Finance is quite widespread in the M&A financing market - the sellers of companies, however, in our experience less common.

Our approach to sell-side financing

In order to be able to involve potential financing partners in a timely manner, the topic of sell-side financing should be addressed as early as possible in the sale process. WTS Advisory’s M&A specialists have an extensive and resilient network of banks and debt funds to find a suitable partner for stapled finance.

Specifically, we can support our clients in the area of sell-side financing as follows:

- Ongoing coordination of financing conditions with our network partners in the area of banks and debt funds are the basis for our services in the area of sell-side financing

- Client and project-related preparation of documents & support of discussions with banks and debt funds

- Negotiation of client and project-related, individual conditions with the aim of a term sheet with the cornerstones of financing

- Addition of the term sheet or the financing proposal to the investment memorandum ("Stapled Finance")

The stated goal of our sell-side financing activities is to maximize the selling price of our clients and to increase the likelihood of implementation and the speed of implementation.

If you are interested and have any questions, please contact us.

Your contact to us

Do you have any questions about our services or WTS Advisory? We look forward to your message or your call!