Business management M&A consulting

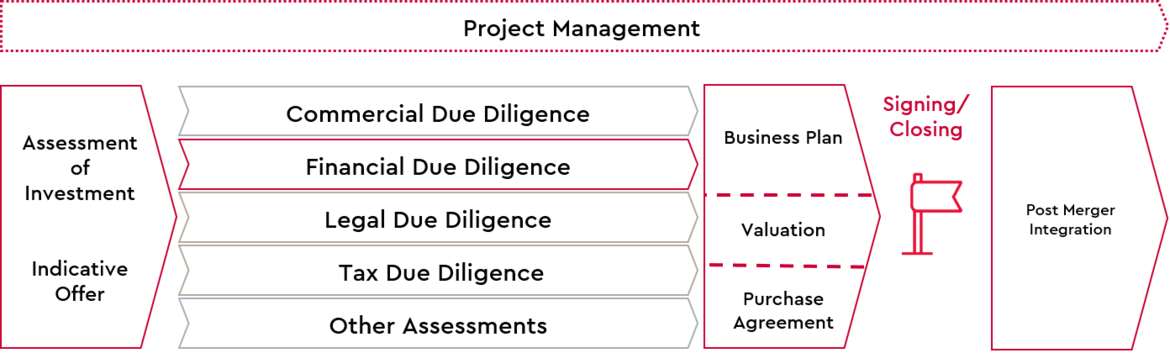

The acquisition and integration of a foreign company is a Herculean task, which is subject to a complex and multi-stage process. Numerous different work streams have to be processed at the same time and countless business aspects within the Merger & Acquisition activity have to be considered.

Business aspects of a corporate transaction

The first step in a company acquisition is always the assessment of the strategic fit: Do acquirers and acquirers fit together? Can synergies be exploited? What might they look like and what is the consequence if the company for sale is taken over by a competitor? These questions are asked before the actual process. Due to the information available, the analysis depth is not yet too high at this time. However, once the first indicative offer has been submitted and the data room is opened, it starts.

- Depending on the transaction size, different business due diligence investigations are carried out. Commercial and financial risks must be identified. The topics must be coordinated in dialogue with (accounting, controlling, operations), corporate finance, the management and, if necessary, the strategy department.

- Questions from the various areas of commercial and financial due diligence must be included in a Q&A list, which is therefore addressed to the seller side. Often the number of questions is limited, so a pre-selection must be made.

- If it is a large transaction object, the question of financing arises. Banks must be audited for financing and the selected bank must then be provided with information for the credit assessment.

- Furthermore, all operational and financial opportunities and risks must be included in the business plan, which is the basis for the company valuation, in which the maximum price to be paid for the company to be acquired is identified. In the course of preparing the business plan, the identified synergies arising from the merger must also be quantified.

The evaluation of this information and the coordination between the different parties are of great importance for the overall assessment of the potential target company. In addition, the entire process is subject to high time pressure - as a rule, the time window for the first and, if necessary, second bidding round is only a few weeks. As a result, if the buyer side is too lean in the relevant departments or generally has little experience with the M&A process, it risks that important topics are not identified in time or investment opportunities are even missed.

M&A process and transaction processing with WTS Advisory

The success factor for the secure and sustainable processing of a transaction is not only the technical competence but also the sufficient availability of capacities with the corresponding expertise. These requirements are guaranteed by WTS Advisory, as our experienced consultants have both the necessary holistic expertise, and support during the entire transaction process along the acquisition value chain from a business perspective. This concerns the core tasks of the process and the M&A project management and extends from the initial advice on the submission of an indicative offer through all phases of the M&A process to the final post-merger integration.

Business M&A Support of WTS Advisory

With your transaction, you benefit from our expertise, which we have acquired in the course of carrying out numerous financial due diligence. At the same time, with the support of the Q&A coordination, we ensure that the commercial, tax and legal due diligence experts, like all other cooperating specialists, have the necessary information. This collected information is therefore incorporated into the business plan, which we create for you in a self-developed professional financial model with different scenarios. Of course, identified synergies and carve-out topics are also taken into account. As principal of the transaction, you can concentrate on the strategic components of the transaction with WTS Advisory as a business advisory partner and enter into negotiations with the seller with excellent preparation.

Support for small transactions

We are also happy to support you with our consulting experts in small" /medium-sized M&A deals, whose value is not in proportion to the execution of a complete M&A process. Often a Red Flag financial due diligence is sufficient for a very small transaction. We provide you with concise information about the identified financial risks in the form of a focused report.

Get in touch with us

We will be happy to discuss your questions and current challenges with you!

Your contact to us

Do you have any questions about our services or WTS Advisory? We look forward to your message or your call!