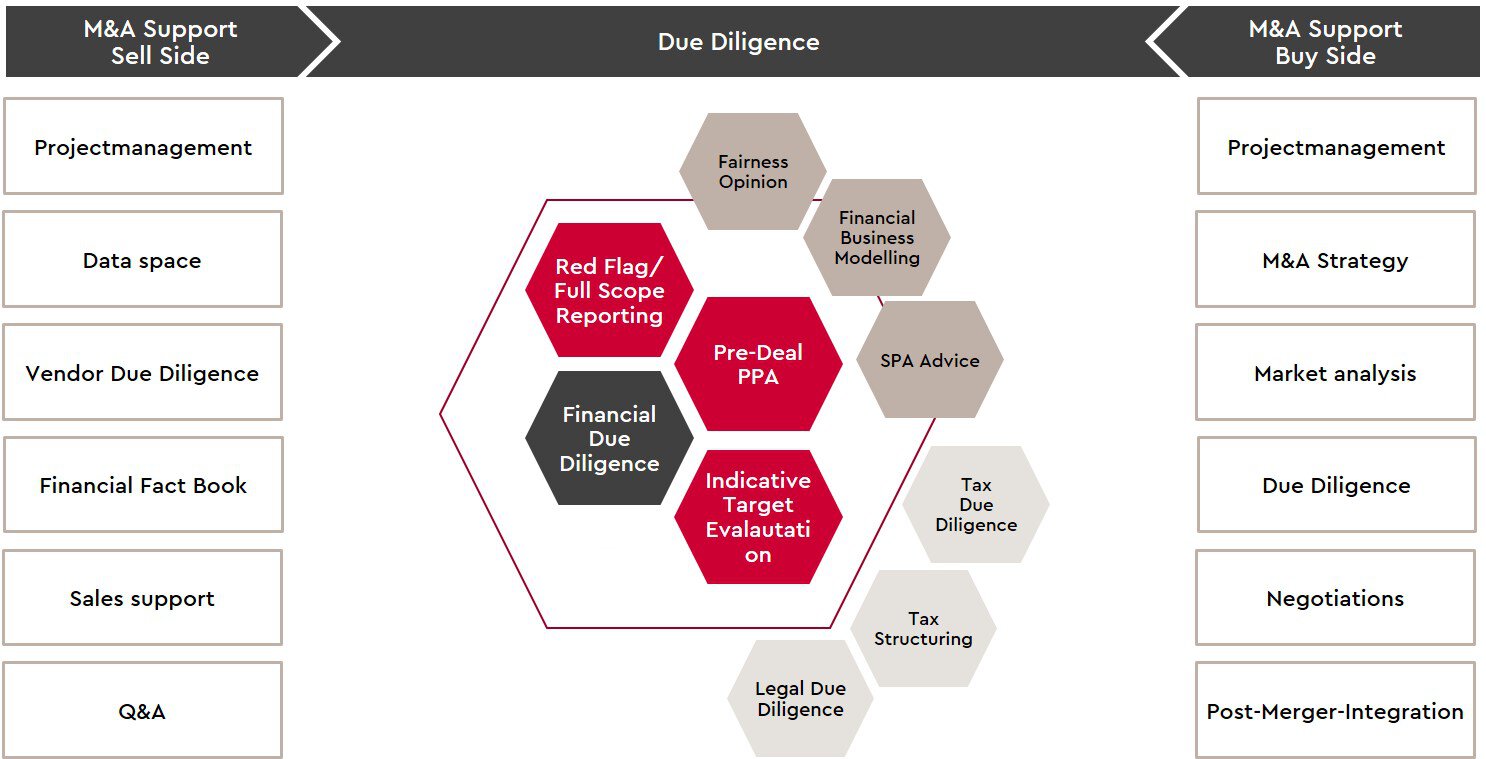

Due Diligence

Financial due diligence is an elementary component of every company acquisition and the basis for related purchase price determinations. It comprises the collection and analysis of financial data of the company to be acquired as well as the identification of potential financial risks of the transaction.

Financial due diligence can be carried out for both the buyer and the seller (vendor due diligence) and is usually supplemented by various other due diligence services, in particular tax due diligence.

Inhalte der Financial Due Diligence

Financial due diligence focuses on analyzing the net assets, financial position and results of operations of a target company on the basis of the company's external and internal accounts. This includes balance sheets, profit and loss statements and cash flow statements, as well as evaluations of the structure of turnover, orders on hand, personnel costs, etc.. In terms of time, past, reporting date and planned figures are considered. Financial due diligence must be distinguished from an audit such as an annual audit, as it specifically generates the information relevant to the client.

The financial due diligence report summarizes the results of the analysis, identifies potential deal breakers and contains recommendations for purchase price clauses and guarantees. The main contents are, for instance:

- Sustainable, adjusted result

- Sales and earnings growth

- Customer and supplier structure

- Net debt, including items not recognized in the balance sheet

- Cash flow development

- Working capital development

- Investment activity

- Year to date analysis, forecast and planning

Buy Side Financial Due Diligence

In buy-side financial due diligence, we support you as the buyer in identifying the financial opportunities and risks of the upcoming transaction, as well as in a later phase after closing.

Sell Side Financial Due Diligence

With sell-side financial due diligence, we support our clients in the necessary careful preparation of a company sale. The preliminary work carried out with the sell-side financial due diligence usually contributes significantly to achieving transparency about the object of sale and optimizing the sales process in terms of time.

Financial due diligence consulting - a service of WTS Advisory

M&A processes are all about speed! We discuss the process and scope of the financial due diligence with you before the start of the project and recommend specific areas of investigation based on our industry experience. Taking into account your budget and cost requirements during the transaction, we develop a customized price offer based on a modular approach consisting of a red flag report and full financial due diligence.

Your contact to us

Do you have any questions about our services or WTS Advisory? We look forward to your message or your call!