Corporate valuation

There are very different occasions for the valuation of a company or part of a company. In most cases, this involves the transfer of parts of the company and the corresponding purchase price, for example in the case of a company acquisition or sale, the settlement of minority shareholders and the departure of shareholders. Non-transactional company valuations are usually tax or family law disputes or severance payments, occasionally also credit assessments. In M&A transactions, there are subjective components of the valuation, for example, synergies of the buyer must be taken into account in the valuation. For all other cases or non-transaction-related company valuations, the objective company value is usually calculated according to IDW S 1, a stand-alone value.

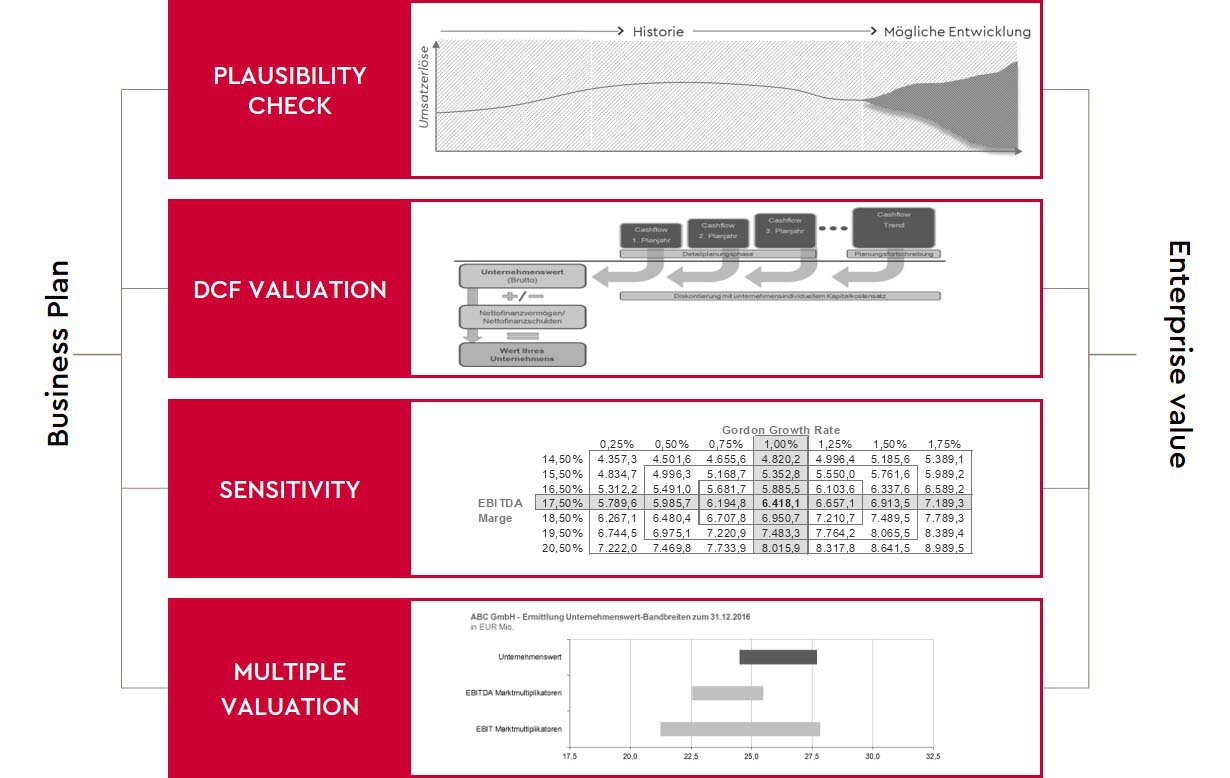

Steps & methods of a company valuation

The following steps shall be carried out in a business valuation:

Plausibility check of corporate planning

Based on historical data and the price/quantity structure of the products or services, we check your business planning for plausibility. Using analyst estimates and market data from comparable companies, we check the plausibility of your business planning and derive a range of sales growth and margins from which your company should regularly move. We explain the assumptions underlying our calculations. If there is no business plan or only a P&L plan available, we will be happy to support you in the preparation as well as in the synergy planning for an upcoming M&A transaction.

Discounted cash flow/income value method (DCF valuation)

At the heart of the evaluation, we transfer the corporate planning into a corresponding evaluation procedure. We derive the cash flows from the planning, determine the capital cost rate, the so-called terminal value and ultimately the company value. We use the WACC method as standard - however, if desired, we also apply the income value method or other methods. Properly applied, these methods lead to the same result with the same assumptions and are the most scientifically recognized as well as in practice. Structurally completely different is the calculation of the so-called value of substance which is needed in practice only in special situations.

Sensitization

In your corporate planning, we try to map the future, expected development of your company with your help. Such forecasts are subject to varying degrees of uncertainty, depending on the industry. In order to make the effects of a different development on the company value as well as estimation errors transparent for you, we calculate corresponding sensitivities for the most important parameters of the valuation.

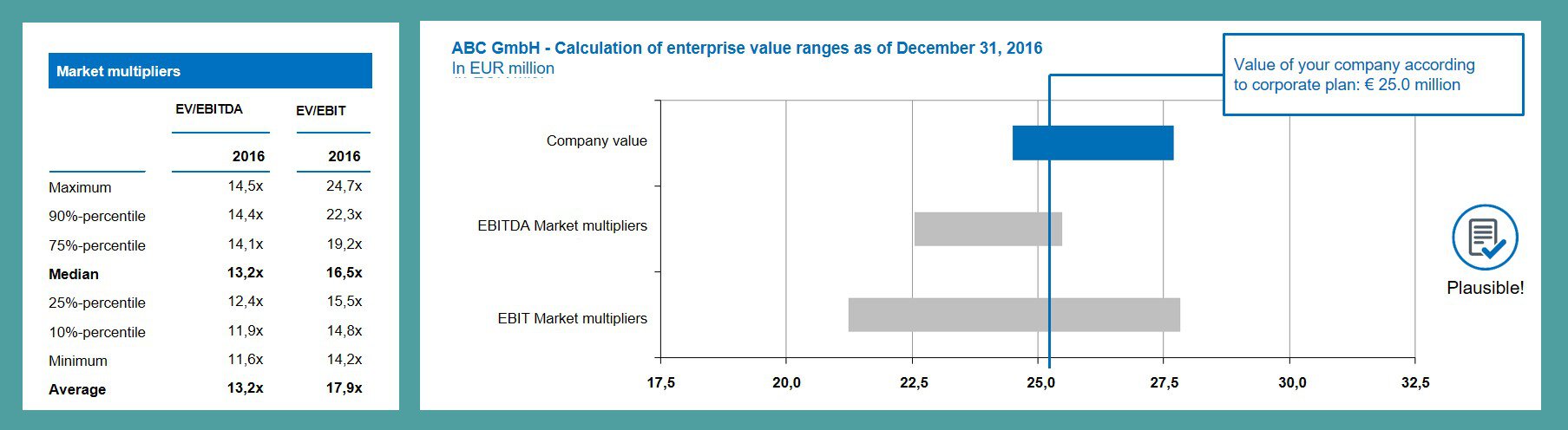

Multiple rating/multiplier method

The final plausibility check of the result is carried out by the evaluation with market multipliers. Based on share prices and M&A transactions of comparable companies, we derive EBITDA (profit/loss before interest, taxes and depreciation), EBIT (profit/loss before interest and taxes) or other industry-specific multipliers, which - used on the corresponding key figure of your company - represent a rough estimate of the value of your company. The company value determined in the DCF valuation should be within the range of multiples, even if both valuation methods follow very different approaches.

Finally, the steps of the company valuation are documented for you in a comprehensive valuation report in accordance with IDW S 1. Your purchase price is backed by an expert opinion. Their compliance with the due diligence obligations of a decision-maker is still comprehensible years later.

WTS Advisory Business Valuations: The purpose determines the scope

In some situations, a full assessment is not necessary. In many cases, an indicative valuation is sufficient for tax purposes, for example, which is limited to the derivation of the company value by means of income value or discounted cash flow procedures and correspondingly short documentation. Please contact us directly - we will explain to you which extent of the assessment is appropriate for your case.

Get in touch with us

We will be happy to discuss your questions and current challenges with you!

Your contact to us

Do you have any questions about our services or WTS Advisory? We look forward to your message or your call!