ESG in the financial sector

With the European Green Deal, the European Union (EU) has set itself the ambitious goal of reducing greenhouse gas emissions to net zero and becoming the first climate-neutral continent. Very high investments are required to achieve this goal - the necessary funds are to be provided mainly from private capital.

Sustainable finance - i.e. taking ESG considerations into account when making investment decisions in the financial sector - is an essential element of the implementation strategy. Banks and insurance companies in the EU play a central role in this transformation process.

With its Strategy for Financing the Transition to a Sustainable Economy, which was most recently adjusted in July 2021, the EU is creating the regulatory framework for the transformation.

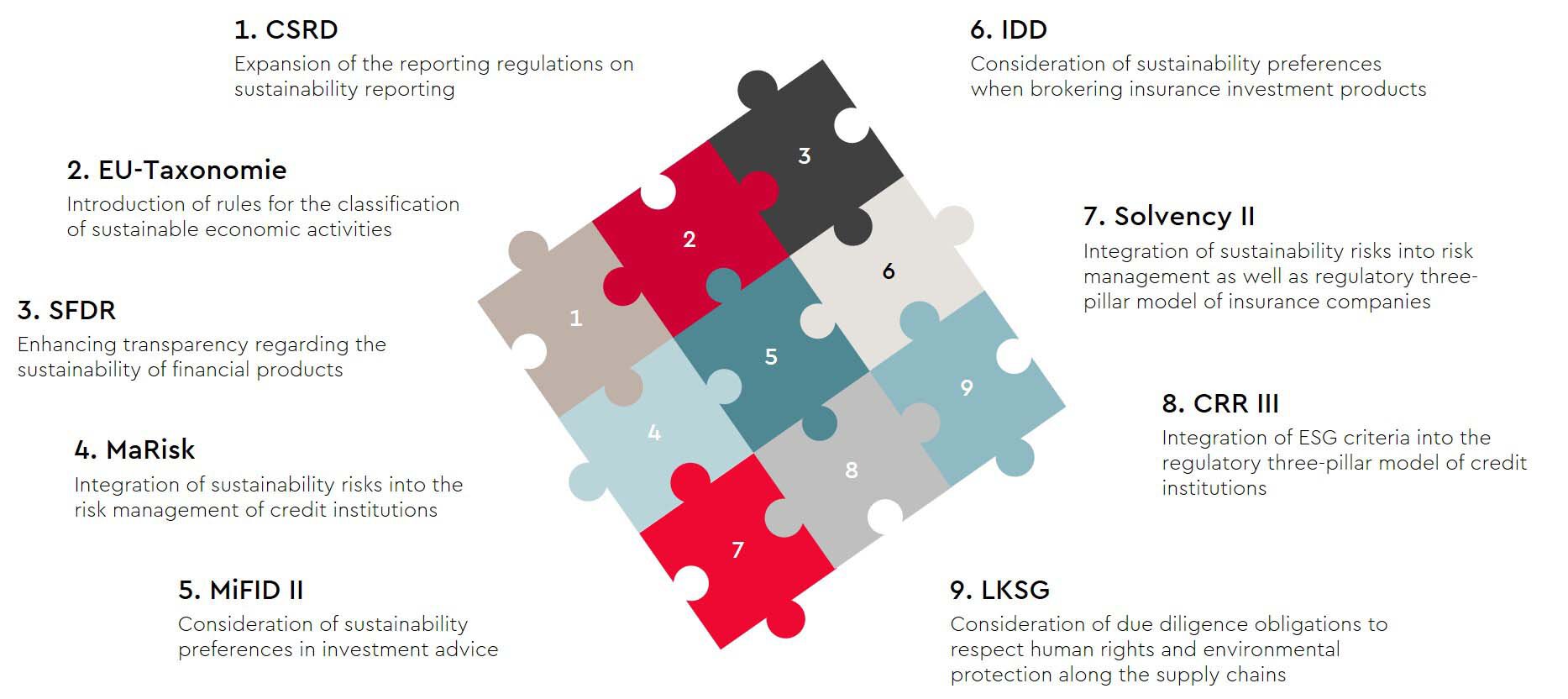

The impact on financial institutions is significant. The key regulatory elements of the implementation strategy include

EU Taxonomy Regulation

The EU Taxonomy Regulation, in conjunction with the complementary delegated regulations, provides a knowledge-based classification system to identify sustainable economic activities. It enables

- a) Determine the extent to which the economic activities are environmentally sustainable within the meaning of the EU taxonomy;

- b) credit institutions, insurance companies and other financial market participants to determine whether financial products invest in sustainable economic activities; and

- c) non-life insurers and reinsurers to determine the extent to which gross premiums written make a positive contribution to climate change.

Banks and insurance companies must therefore collect and take into account all taxonomy-relevant information of their customers or their investment objects. The requirements for credit institutions also extend to private borrowers to a reduced extent.

SFDR - Sustainable Finance Reporting Directive

The SFDR - also known as the Disclosure Regulation - contains extensive reporting requirements regarding the issuing or investment activities of financial services providers. The requirements include, among other things, information on sustainability risks and potentially adverse effects (Principal Adverse Impact - PAI) of investments. Furthermore, there is a three-level categorization of financial products depending on their impact on the environment and society.

Sustainability preferences of investors (MiFID II)

As part of the introduction of the new Financial Markets Directive (MiFID II), banks and insurers must take into account the sustainability preferences of their customers and investors in addition to the previous investment objectives (investment purpose, investment duration and risk tolerance) when advising customers. Institutions may only recommend financial products that are in line with all of the customers' investment objectives.

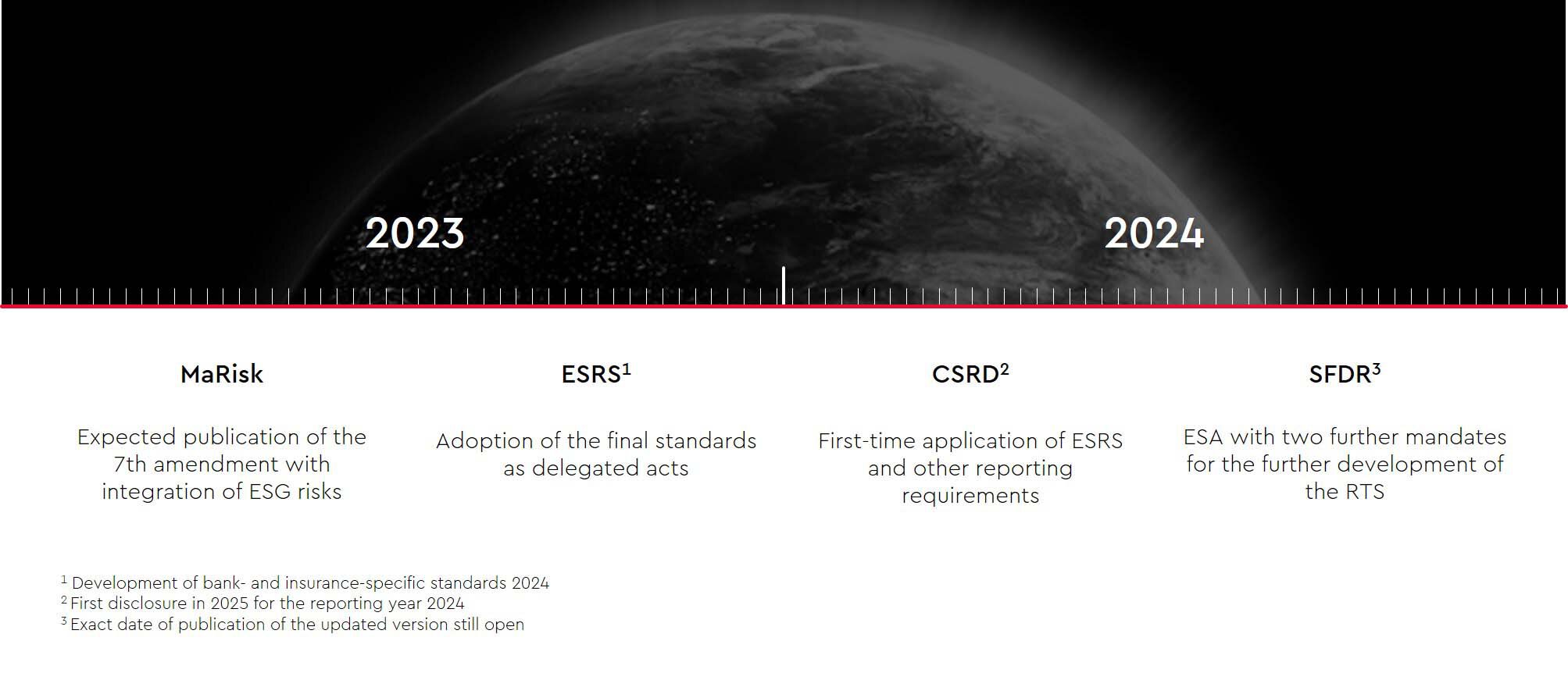

Bank risk management (MaRisk)

The 7th MaRisk amendment integrates sustainability-related requirements into the risk management of credit institutions.

Banking and insurance supervision (Basel III/Solvency II)

In the updated Capital Requirements Regulation (CRR III) and Capital Requirements Directive (CRD IV), the EU Commission has integrated the management of ESG risks in addition to the contents of the Basel Framework III. The requirements cover identification, management and disclosure of sustainability-related risks. Furthermore, monitoring is carried out as part of the supervisory review and evaluation process (SREP). If necessary, measures such as additional capital requirements can be taken by the banking supervisory authority.

Prospects

In the future, banks and insurance companies will have to focus more on making their business models sustainable, integrating ESG criteria into their decision-making processes, and meeting regulatory requirements. In doing so, they will also have to respond to the challenges of climate change and other global sustainability issues and find solutions to them in order to be successful in the long term.

Support of WTS Advisory in the implementation of your ESG strategy

Banks and insurance companies need ESG data as a basis for implementing their sustainability strategy and for fulfilling their various ESG-related obligations in the context of planning and reporting.

WTS Advisory supports you in developing your ESG strategy, collecting key performance indicators, integrating them into reporting and anchoring them within bank management. Together with you, we develop a customized roadmap based on your requirements and the legal framework and support you in the implementation in your IT landscape - up to the complete automation of end-to-end processes in the creation of notifications and reports.

If you are interested and have any questions, please do not hesitate to contact us.

Your contact to us

Do you have any questions about our services or WTS Advisory? We look forward to your message or your call!