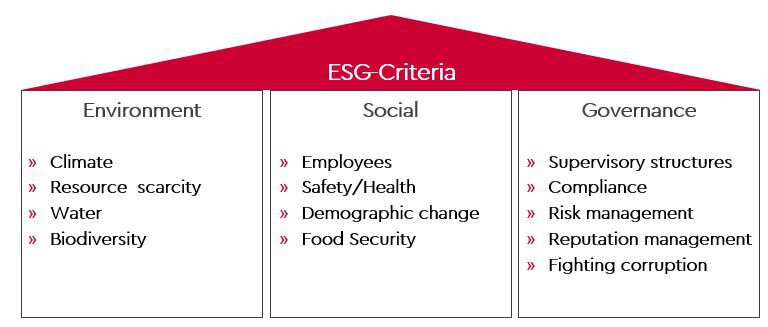

Integration of non-financial key performance indicators (ESG)

Sustainable Finance refers to the inclusion of ESG criteria in the decisions of financial actors in order to support sustainable economic growth. The awareness of financial actors regarding the need to mitigate ESG risks through appropriate management is to be strengthened by the supervisory measures and transparency is to be created in this regard. In particular, the longer-term nature of ESG risks and the uncertainty regarding their valuation and pricing must be given greater consideration, according to the supervisory authority.

The criteria on Environmental, Social and Governance (ESG)

- Strategy

The first step is to define the strategy with regard to the pursuit of the ESG criteria. Is it really a matter of raising earnings and cost potentials through the pursuit of objectives or merely of meeting the supervisory "minimum jump level" (cf. EBA/REP/2021/18)?

- Definition of the relevant criteria/dimensions

Not all of the criteria and dimensions mentioned by the regulators are of decisive relevance for financial service providers. Even between the individual financial service providers, the different business strategy goals give reason to focus on different criteria as well as dimensions. A real estate financier will focus more on environmental factors of its asset side, while a payment processor will give more weight to governance. The targeted selection and definition of the relevant dimensions is not only essential in terms of achieving the objectives, but also has a decisive influence on the technical implementation and integration effort.

- Selection of relevant key figures

Only what can be measured can also be controlled. Whereas in the past financial service providers were generally able to measure target achievement on the basis of cash flows and present values, this is no longer readily possible when measuring target achievement of non-financial indicators such as ESG criteria. Here, new indicators such as energy ratings, social and governance indices must be implemented and used in order to continue to make the target achievement of strategy pursuit measurable and thus controllable. The difficulty here often lies in the tension between measurability and relevance.

- Embedding in steering committee

Non-financial indicators also pose new challenges for the controlling units. Analogous to market, credit and operational risks, a risk appetite, limits as well as triggers must be defined. This poses challenges for banks due to the lack of experience in dealing with the corresponding risks.

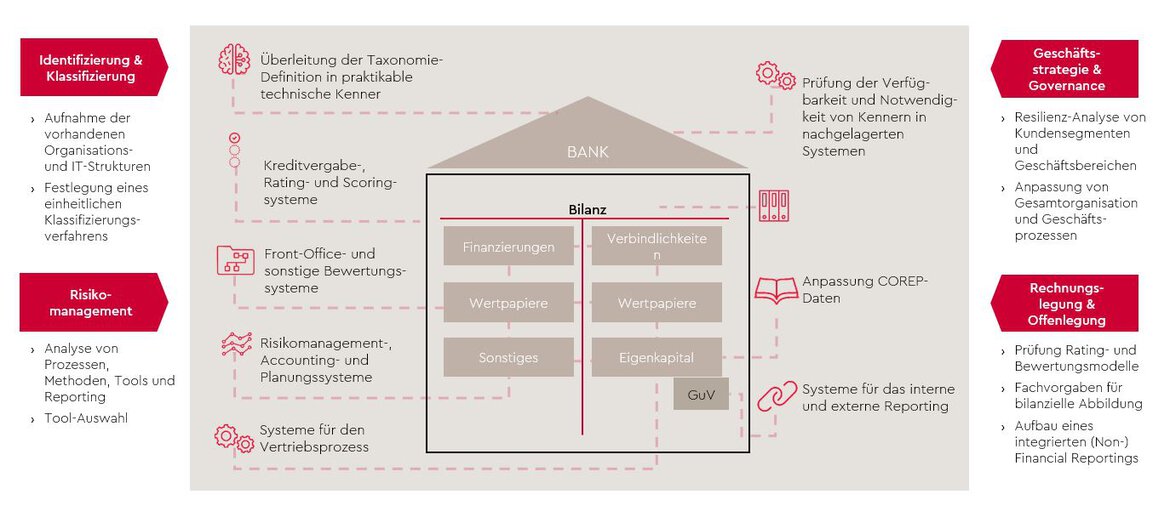

- Technical implementation

To ensure continuous control, timely and regular reporting of key figures is essential. The first step is to ensure that all data relevant to the determination of key figures can be recorded via interfaces or user interfaces. In a further step, existing systems must be adapted in such a way that they can handle the information, some of which is new, and process it in the sense of determining and controlling key figures. This includes, above all, the integration into relevant control-relevant reports.

Support of WTS Advisory in the integration of non-financial key figures

WTS Advisory will be happy to support you in the development of your ESG strategy, the selection of relevant measurable criteria and indicators, and their anchoring within bank management.

If you are interested and have any questions, please do not hesitate to contact us.

Your contact to us

Do you have any questions about our services or WTS Advisory? We look forward to your message or your call!