FINREP

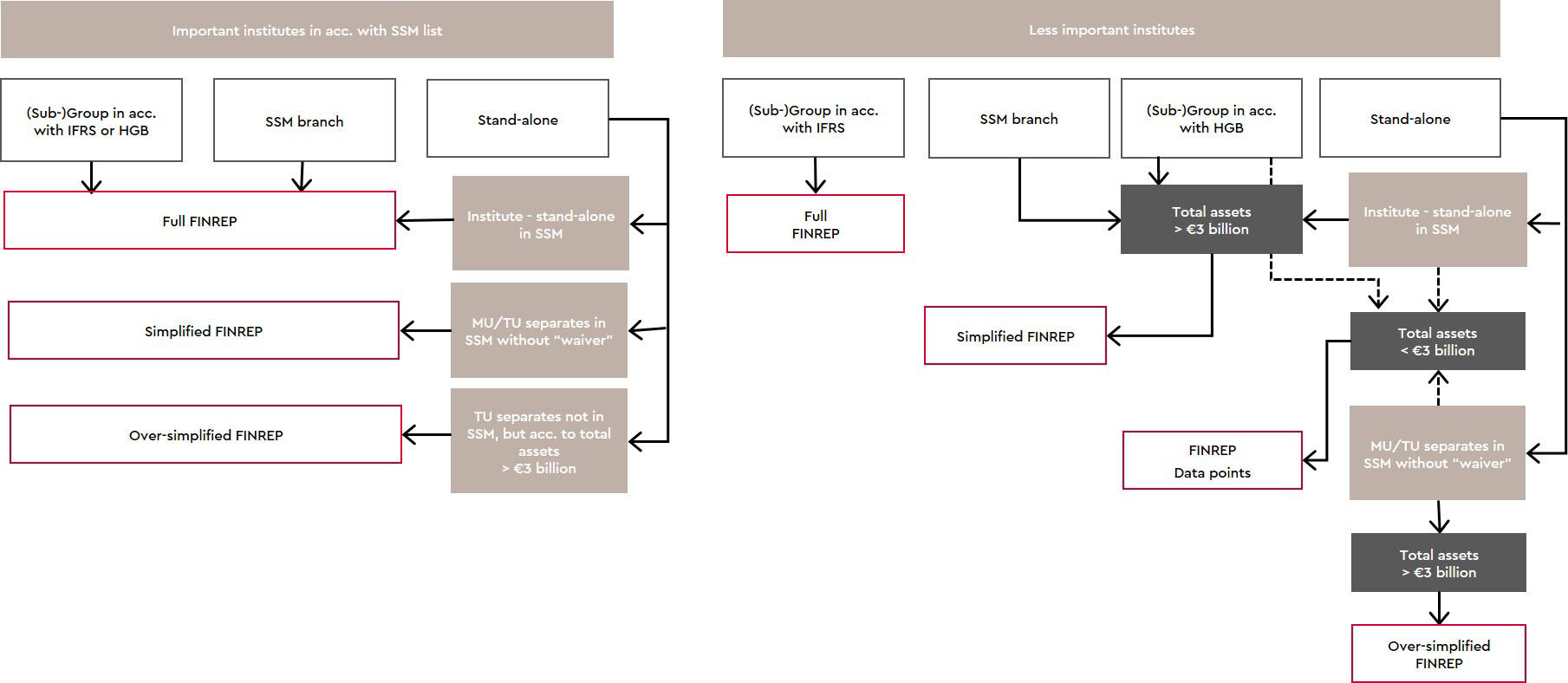

Since the ECB published the final version of the Regulation on the Reporting of Regulatory Financial Information in 2015, financial reporting has affected almost every credit institution in the meantime. There are reporting obligations for Group institutions under IFRS where such have regulatory significance as well as for smaller individual institutions under the Commercial Code (HGB), with the type and scope of these obligations being determined by the significance and size of the institution and the accounting regulations to be applied.

Adjustments to FINREP Templates due to the Introduction of IFRS 9

The introduction of IFRS 9 has resulted in extensive changes to the FINREP templates according to IFRS, which are to be applied for the first time as of the reporting date of March 31, 2018. However, the so-called nGAAP templates were also adapted for Commercial Code (HGB) users in order to maintain consistency with IFRS reports. In addition, the opportunity was seized to implement potential for optimization that arose in past years from the practical experience of the nGAAP users. Less important institutions must apply the revised nGAAP templates for the first time as of the reporting date of March 31, 2019.

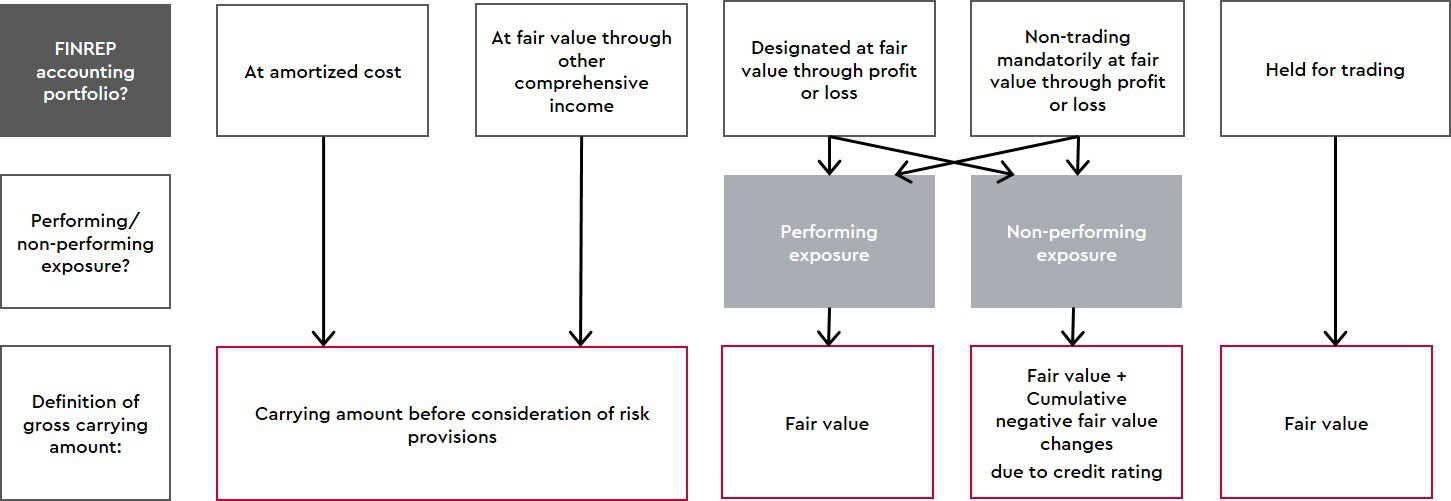

The replacement of IAS 39 by IFRS 9 led to adjustments in almost every template for the FINREP templates according to IFRS. On the one hand, the amended IFRS 9 holding categories resulted in new FINREP accounting portfolios, and on the other hand, it was necessary to implement both the introduction of the expected credit loss model with the 3-step approach for determining risk provisioning and the adjustments relating to hedge accounting in the FINREP templates.

The introduction of the new FINREP templates in accordance with IFRS eliminated the conceptual weaknesses in the previous definition of the gross book value. There are now different derivations on the basis of the new FINREP accounting portfolios:

Permanent Adjustments to FINREP Templates – Also in Accordance with IFRS 9

Even after the changes to the FINREP templates caused by IFRS 9, FINREP remains an ongoing issue since each change in the reporting structure constantly affects another aspect. In addition, the scope of the content analysis and queries on FINREP reporting has so far been rather manageable, but this will change in the future as a result of a shift in focus.

WTS Advisory Support in the Context of FINREP

WTS Advisory has successfully carried out various FINREP projects for both IFRS and HGB institutions and has many years of experience in this area. Even after the introduction of FINREP, WTS Advisory will provide advice on the implementation of open issues arising from regulatory requirements or changes in accounting regulations, reporting structures and processes. In a review, WTS Advisory checks the derivation from customer and product groups for the FINREP report and ensures that it can be reconciled with other regulatory reports, in particular COREP. In addition, we support the harmonization of deviations between IFRS and FINREP in the requirements.

Where banks prepare IFRS consolidated financial statements in accordance with the German Accounting Directive for Banks (Kreditinstituts-Rechnungslegungsverordnung, RechKrdV), there are also regular challenges in the consistent reconciliation between financial statement disclosures and the FINREP report. Here, too, the experienced consultants at WTS Advisory provide support ranging from the implementation of semi-automatic reconciliation processes (also for institutions under the Commercial Code) to the design of balance sheet and income statement structures compatible with FINREP.

If you are interested or have any questions, please contact us.

Your contact to us

Do you have any questions about our services or WTS Advisory? We look forward to your message or your call!