MaRisk Implementation

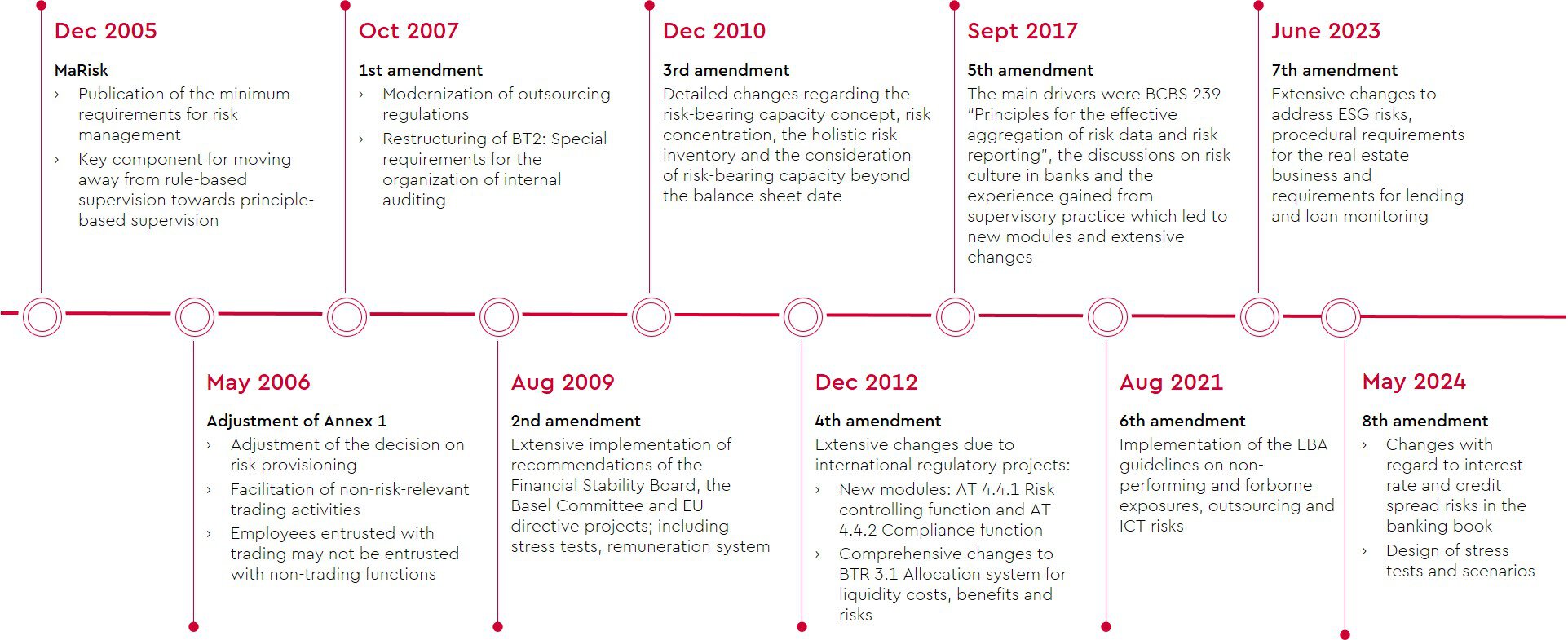

The Minimum Requirements for Risk Management (Mindestanforderungen an das Risikomangement, MaRisk*) are a part of the regulatory Supervisory Review and Evaluation Process (SREP) for banks and are thus part of the second pillar of Basel III. With these requirements, the special organizational obligations of banks in accordance with Section 25a (1) of the German Banking Act (Kreditwesengesetz, KWG) were specified for the first time in 2005 for the implementation of an adequate and effective risk management. After several updates, the last version of MaRisk was published in May 2024, with the inclusion of more recent developments, particularly on account of international regulation initiatives.

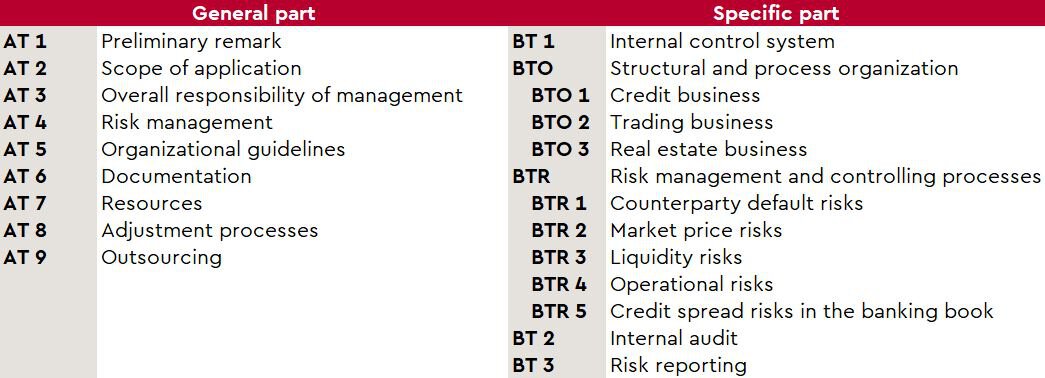

MaRisk has a modular structure: After the determination of fundamental requirements (Allgemeiner Teil, AT), the specific part (Besonderer Teil, BT) defines specific requirements of the structural and process organization, risk management processes, design of the internal audit and the risk reporting:

Regular adaptation to current challenges

MaRisk has been revised several times since it was first published. With the 5th MaRisk amendment, international regulatory initiatives were increasingly implemented. Since the 7th MaRisk amendment, these are no longer taken into account exclusively through explicit adoption, but also through direct references to EBA guidelines.

Consideration of ESG risks

With the 7th MaRisk amendment in June 2023, ESG risks were integrated along the existing MaRisk modules. The effects of ESG risks were factored into the risk inventory, risk-bearing capacity, business strategy, risk management and controlling processes, internal stress tests and risk reporting.

In addition, the requirements for granting and monitoring loans have been expanded. Among other things, the lending process must be differentiated according to borrower, collateral and financing object. Overall, the expansion of the requirements is aimed at increasing the quality of the loans granted and stabilizing the NPL and forbearance level.

Furthermore, the 7th MaRisk amendment introduced procedural requirements for the real estate business in analogy to the credit processes and specified comprehensive requirements for the use of models.

Interest rate and credit spread risks in the banking book

Most recently, the 8th MaRisk amendment, which came into force in May 2024, implemented the EBA guidelines on interest rate risks and credit spread risks in the banking book (EBA/GL/2022/14).

Generally, it is up to the institution to decide how it takes account of interest rate risks as both is possible: a separate treatment in the trading and banking book or an integrated treatment at the institution level as a whole. However, it is crucial that both the income-oriented and the present value perspective are taken into account when measuring and managing interest rate risks. Risk management specifications must be calculated for both perspectives as soon as the risk appetite is defined (see more details in BTR 2.3). The extent of the positions (all interest rate-sensitive instruments in the banking book including non-performing risk positions) and the specifications for the measurement approaches (determination of gap, basis and option risk) are determined by direct reference to the EBA guidelines (EBA/GL/2022/14).

As with interest rate risk, when determining credit spread risks in the banking book, the effects on both the result under commercial law and the market values or present values of the positions must be considered. They must be taken into account when assessing risk-bearing capacity, whereby both the income-oriented and the present value perspective must be included. The standards for determining, identifying and assessing credit spread risks are set out in BTR 5 and the direct references to the specific requirements of the EBA guidelines (EBA/GL/2022/14). Whether credit spread risks are considered as a separate risk category or as part of credit risks or market price risks is subject to the methodological choice of the institutions. Regardless of the classification, they must be determined separately in each case.

When implementing MaRisk, the principle of double proportionality must be respected, according to which both the individual structure and the regulatory implementation review must be based on the size and risk profile of a credit institution.

Based on this requirement, WTS Advisory supports the implementation and optimization of the individual MaRisk modules and develops appropriate solution packages depending on the size and complexity of the institution. Depending on requirements, the range of services extends from a comprehensive GAP analysis to the individual implementation of sub-modules, taking into account the specific requirements of the EBA guidelines.

In the areas of risk reporting, taking into account efficiency and automation potential, as well as the management of ESG risks, WTS Advisory has in-depth methodological knowledge and implements this knowledge taking into account the respective institution-specific framework conditions.

If you are interested or have any questions, please contact us.

*We refrain from using the German terms translated into English due to the German context in which they are to be considered.

Your contact to us

Do you have any questions about our services or WTS Advisory? We look forward to your message or your call!