CSRD - EU creates legal framework for sustainability

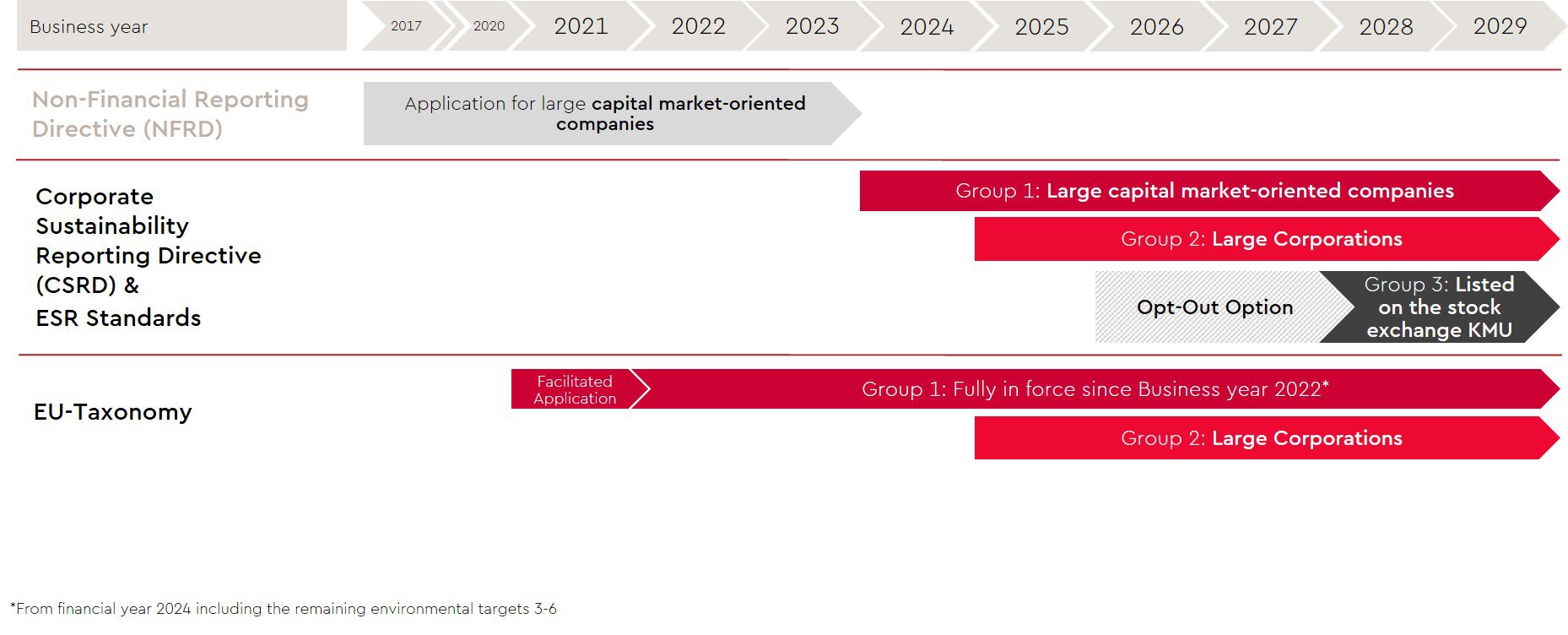

The EU is pursuing the clear goal of putting responsibility towards society at the core of every business strategy. The political framework was created in 2014 when the EU Commission implemented the first reporting obligation for companies in the area of non-financial information through the CSR Directive. In 2017, this EU directive was transposed into German law and large, capital market-oriented companies and financial institutions were obliged by the CSR Directive Implementation Act (CSR-RUG) to report on sustainability issues as part of a non-financial statement (NFS).

Another significant milestone was achieved at the end of 2019 with the EU's "Green Deal", which aims to achieve climate neutrality in the EU by 2050. As part of this, the CSR Directive was revised and the EU taxonomy was approved.

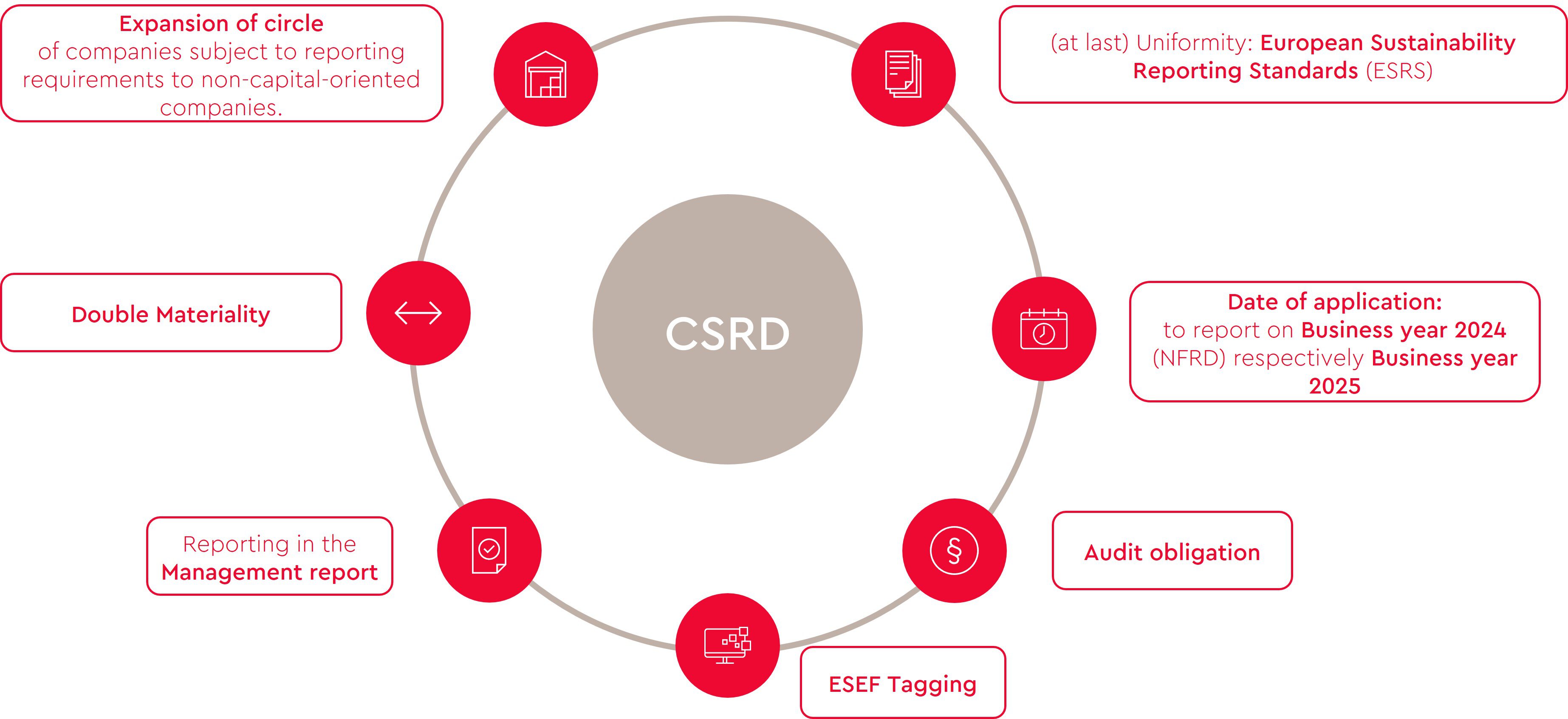

The CSRD adopted by the EU in November 2022, which replaces the old CSR Directive, further expands and specifies the reporting obligations. Among other things, this affects the group of companies subject to reporting requirements. Under the CSRD, large capital market-oriented companies that were already subject to reporting requirements are now required to report for the financial years beginning in 2024. From 2025, large, non-capital-market-oriented companies will follow and from 2026, small and medium-sized listed companies will also be subject to the reporting obligation under the CSRD. However, there is an opt-out option for these companies until 2028.

Changes to the content of the CSRD include the legal clarification of the principle of "double materiality", the definition of the management report as the only permissible reporting format, the obligation to audit the sustainability report (as part of the management report), the extension of ESEF tagging (expected from 2026) to sustainability reporting and the first-time specification of uniform content standards - the European Sustainability Reporting Standards (ESRS).

The ESRS are the framework for reporting non-financial performance indicators (Article 29b). The first draft was published in November 2022 by EFRAG on behalf of the European Commission. After several revisions and feedback phases, the final ESRS was published by the European Commission on 31.07.2023 as the Delegated Regulation (EU) 2023/2772. It is available here.

The sustainability reporting standards define the disclosure requirements in the areas of environmental, social and corporate governance. These disclosure requirements are both quantitative (KPIs, key figures, etc.) and qualitative (descriptions, strategies, etc.). The ESRS are divided into 12 standards, 2 cross-cutting standards ESRS 1 and ESRS 2 and 10 thematic standards: ESRS E1-5 for environmental aspects, S1-S4 for social aspects and G1 for governance aspects. The following topics are covered in the reporting requirements: E1 includes disclosure requirements on the topics of climate change, energy and adaptation to climate change. E2 focuses on the topics of air, water and soil pollution as well as microplastics and substances of concern. In E3, the topics of water and water consumption as well as marine resources are important. E4 deals with biodiversity and species diversity and E5 with resource use and waste.

In S1, the company's own employees and their working conditions are relevant, whereas S2 focuses on the workers in the value chain and their working conditions. S3 includes disclosure requirements on affected communities and their rights and S4 on end users and consumers. The last thematic standard, G1, concerns topics such as compliance, corporate culture and anti-corruption.

Once the company has carried out a materiality analysis, it is possible to determine which of the ESRS topic standards are relevant for the company and which specific quantitative and qualitative disclosure requirements result from this.

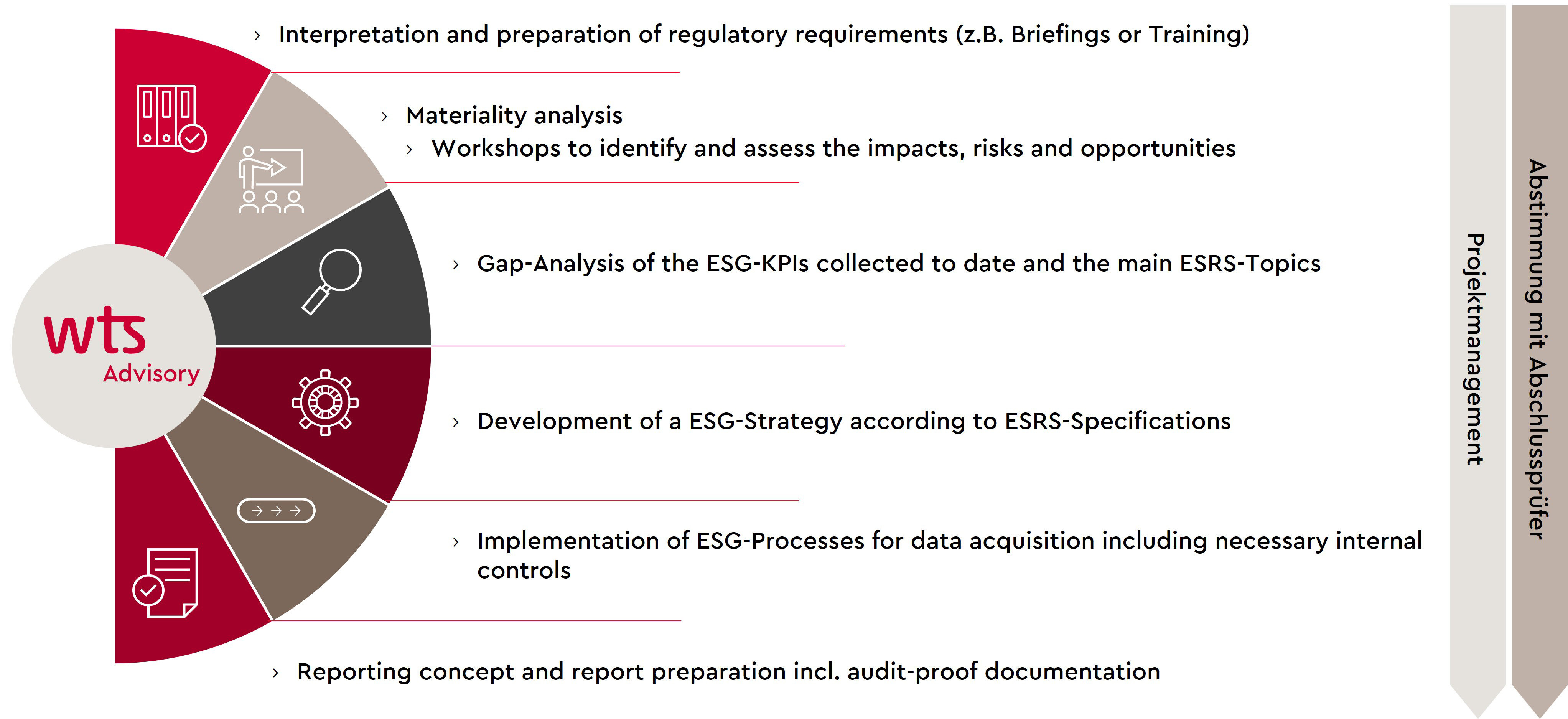

Can't see the wood for the trees? No matter how complex your ESG challenges are, we analyze and structure them together with you and accompany you step by step on your way to more sustainability and CSRD-compliant and audit-proof reporting. Get started now with ESG Discovery with our in-house start-up aid for your entry into the ESG transformation.

Concentrated ESG expertise, compactly packaged in solution-oriented workshop formats: whether materiality analysis, ESRS implementation, EU taxonomy, ESG strategy, ESG ICS, green finance or ESG data value creation, together with our interdisciplinary team of ESG experts, we offer modular workshops that are perfectly tailored to your individual needs and challenges. Your company is unique - your workshop should be too.

If you don't know where to start: We are happy to guide you through the current regulatory requirements, latest industry trends and best practices on the topics that are relevant to you. We break down the plethora of information on the ESG topics relevant to your company to the essentials and make it available to you in the form of action-oriented work packages.

Ready, set - go! As a result of our ESG Discovery Workshops, you will receive an ESG roadmap with a tangible and clearly prioritized ESG agenda for your company. From the quick wins to the really big steps: start your ESG transformation with us!

Are you interested in an initial consultation on the ESG Discovery Phase to gain an insight into the range of our ESG solutions? Please don't hesitate to contact us!

Your contact to us

Do you have any questions about our services or WTS Advisory? We look forward to your message or your call!