ESEF – The Future Format for Financial Reports

Implementation of the Uniform Reporting Format

The “European Single Electronic Format” (ESEF) is a new EU requirement for all companies that have issued securities within the EU.

As a result, the companies in question will be required to prepare their annual financial reports in XHTML format starting on 1 January 2020. In addition, the consolidated IFRS financial report must contain certain “inline eXtensible Business Reporting Language”, or iXBRL elements. Put simply, the introduction of the ESEF means that all figures and information from the previous financial statements will be provided with a standardized label, or tag. These tags then follow a clearly defined IFRS taxonomy that enables IT systems to automatically read out annual financial statements and consolidated financial statements.

The aim of the ESEF is to ensure that IFRS consolidated financial statements can be better compared with each other in the future, irrespective of structure, language and format, while providing a faster exchange of information and avoiding manual tasks and system discontinuities.

In order to keep company effort at a reasonable level for the first step, the ESMA decided that only the “primary financial statements”, i.e. the balance sheet, the profit and loss statement, the statement of comprehensive income, the cash flow statement and the statement of changes in equity, need to be prepared in a structured way.

IFRS taxonomy extensions are planned for entity-specific disclosures.

Mandatory, identifiable labeling (“tagging”) is not stipulated for the IFRS notes to the consolidated financial statements until 2022. In addition, the chapters in the notes to the financial statements may initially be given a collective iXBRL tag.

No direct transmission of financial statements to the ESMA is planned. The national business registers will continue to exist. However, there will be a central European register with reference to the national registers (European Electronic Access Point).

Success Factors for the ESEF Implementation

The requirements of an ESEF-compliant financial report should not be underestimated:

- Determination of the requirements and careful and needs-based selection of the IT software for iXBRL tagging

- Compliance with legal requirements and applicable IFRS standards

- Availability of detailed IFRS knowledge and extensive reporting skills

- Comprehensive knowledge of IFRS taxonomy and ESMA tagging rules

- Software expertise for the technical implementation of tagging

- Close cooperation between the involved corporate departments such as accounting, IT, legal and investor relations

- Allocation of limited resources and consideration of other regulatory projects (new IFRS standards, CSR Directive, etc.)

The implementation of the new report format consists of a very dominant functional and a technical component. Once the report components affected by the new regulation have been identified, we will help you compare their individual elements with the IFRS taxonomy.

If any deviations (“gaps”) are identified, company-specific taxonomy extensions may need to be made. In this case, we will also carry out the necessary anchoring and document the tagging clearly in Excel.

Our ESEF project experience also enables us to provide you with up-to-date benchmarking know-how.

Software

When transferring financial reports to the machine-readable iXBRL format, there are basically two possible software approaches:

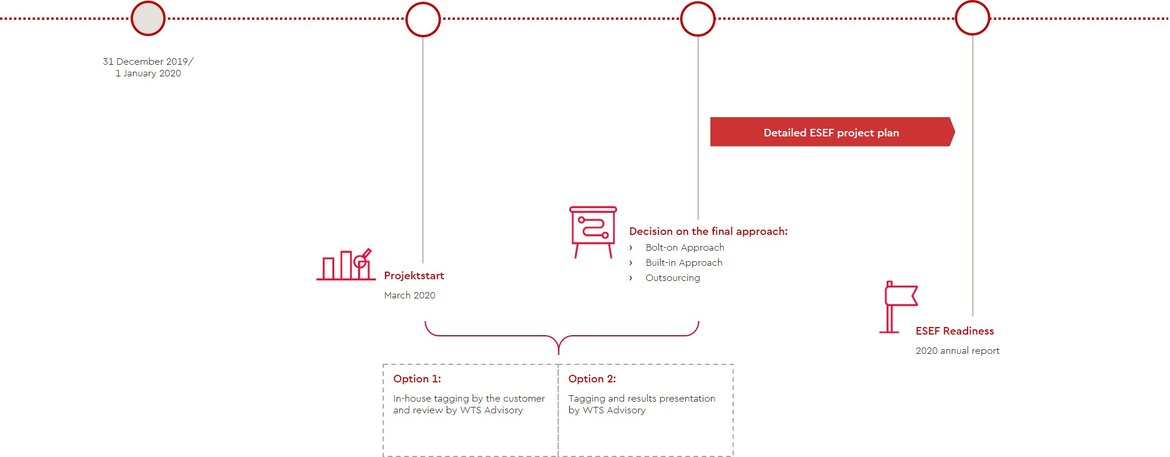

One is the integration of the tagging software in the financial report preparation process as part of a disclosure management system (built-in approach) and the other is a separate, downstream software solution (bolt-on approach). Together with you, we define the requirements for the necessary ESEF software and accompany you in the selection of the most suitable solution that best covers the requirements of your company in terms of costs and benefits.

As a competent partner, WTS Advisory will assist you throughout the ESEF project or during individual process steps. To this end, we offer the following:

- Technical understanding and specialist accounting expertise from a single source

- Overview and audit security through complete transparency

- Relief for your own staff, especially from time-consuming initial mapping and tagging

- Efficient project management with predefined project goals and time-tested approaches for successful project implementation

- Reduction of complexity and effort through software-supported ESEF reporting

- Independence from the auditor profession

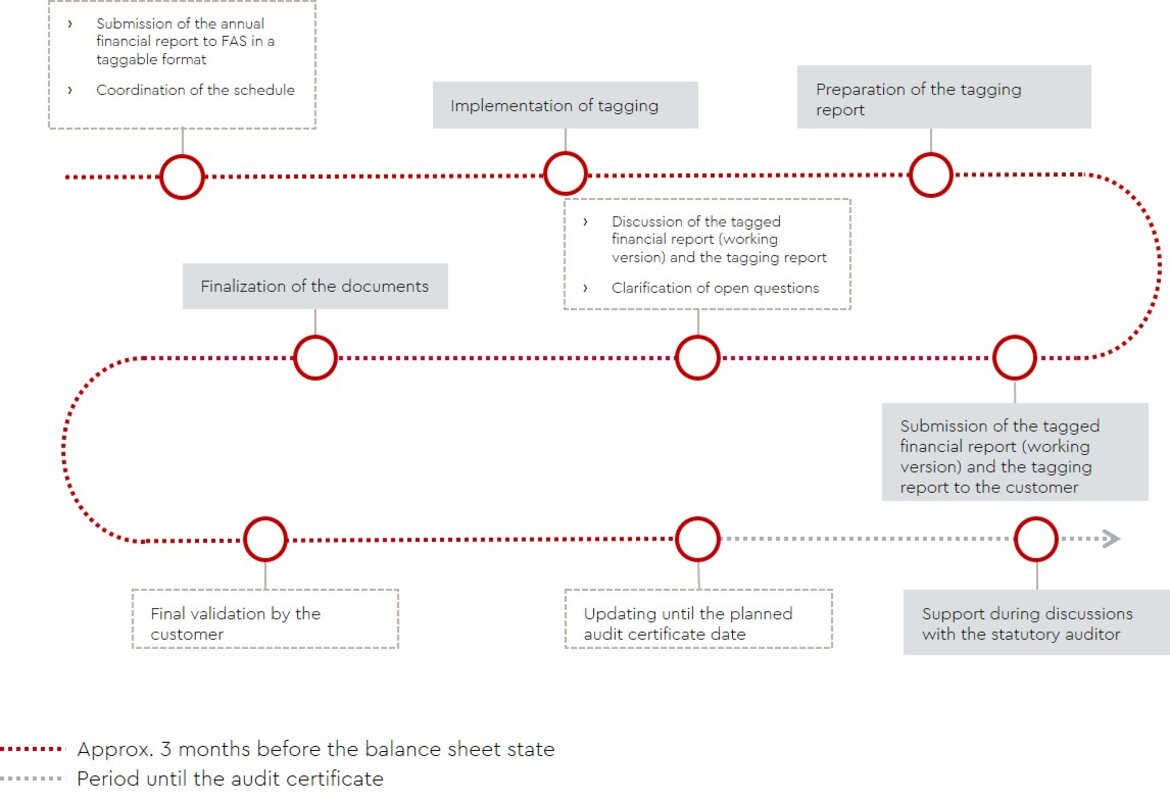

In addition, you can also choose to outsource the entire ESEF process to WTS Advisory. Our outsourcing approach is as follows:

An upstream sample financial report based on the 2019 fiscal year will help you decide on the right implementation approach and address questions early on that may need to be clarified. This will ensure that nothing more will stand in the way of ESEF readiness for preparing the 2020 financial report on time.

If you are interested or have any questions, please contact us.

Your contact to us

Do you have any questions about our services or WTS Advisory? We look forward to your message or your call!